InvestorLine Self-Directed

Our easy-to-use online trading platform lets you invest in stocks, ETFs, mutual funds and more! We provide research, tips and tools so you can make every trade with confidence.

Commission free trading on some of Canada's most popular ETFs footnote dagger

Elevate your trading strategy with our new BMO Active Trader platform

Advanced tools and capabilities like multi-leg options, screeners, strategy builders with margin trades evaluated using real time buying power calculations

Benchmark, Customize and Track your performance with our easy-to-use analysis tools

Build a more sustainable portfolio with environmental, social and governance insights

Special Offer:

Double Your Bonus and get up to $10,000 footnote star

So good, it’s award-winning

Invest with confidence using powerful tools and research with BMO InvestorLine Self-Directed. Recognized for delivering an easy, reliable experience that helps you make smarter moves.

BMO InvestorLine awarded 2026 Best Online Broker by moneyGenius.

What Self-Directed costs

Self-Directed gives you everything you need to make informed investments with no surprise fees or additional charges. Simply pay one low flat-rate fee for each online trade you make.

$9.95 flat fee for each trade you make online

+ $1.25 per options contract

$0.00 commissions for a selection of Canada’s most popularExchange traded funds

4 types of investment accounts available with Self-Directed

These accounts are registered with the federal government and offer you certain tax incentives. Registered accounts can help with retirement investing, saving for purchase of your first home, saving for education, making other large purchases, and more.

Great for: Investing in the future while getting tax incentives.

Non-registered accounts don’t offer any tax advantages. There are no limits to your contributions, however, so you’re free to contribute and withdraw as much as you want.

Great for: Saving for a large purchase like a down payment.

Accounts offered: Individual, Joint, Cash or Margin

Do you have a pension and are leaving your company? A locked-in account allows you to hold your money once you’ve left, and keep it in the account until you’re ready to enjoy your retirement.

Great for: Investors with a pension.

Accounts offered: L I R A, LRSP, RLSP, LRIF, LIF

A corporate or non-personal account is a type of non-registered account that is set up in the name of a business or other entity.

Great for: Investing on the behalf of another individual, a business, or an association.

Accounts offered: Trusts, estates, associations, corporations, investment clubs or partnerships, personal holding companies.

Investment types available with Self-Directed

Stocks

Stocks are easily tradeable units of ownership in a publicly traded company. Get access to stock trading on the major North American exchanges, including the Toronto Stock Exchange (TSX), the New York Stock Exchange (NYSE) and NASDAQ

Options

Options are contracts that give you the right to buy or sell stock at a set price by a certain date. A great way to broaden your opportunities and help to reduce risk.

CDRs

Canadian Depositary Receipts allow investors to invest in global companies that are listed on foreign exchanges. CDRs are listed on a Canadian exchange and priced in Canadian dollars.

ETFs

Exchange traded funds (ETFs) are a combination of equities, fixed income and other assets. They can be traded just like stocks, and come with typically low management fees. We offer a selection of ETFs, commission-free.

GICs

A guaranteed investment certificate (GIC) is a secure investment that guarantee 100% of your principal, meaning your initial investment is safe, no matter what the market does.

Mutual Funds

A mutual fund pools your money with other investors to buy a portfolio of investments overseen by a portfolio manager. They are easy to purchase with low investment amounts.

Bonds

Bonds are fixed-income contracts that function like loan agreements between investors and borrowers.

Experienced trader? Elevate your trading with BMO’s 5-Star Program

Tailored for seasoned traders, our program offers exclusive tools, and dedicated support for those with 15+ trades per quarter or over $250,000 in investments.

Preferred rates and pricing

- Professional-level tools, like BMO Active Trader

- Industry-leading research

- Dedicated 5-star support

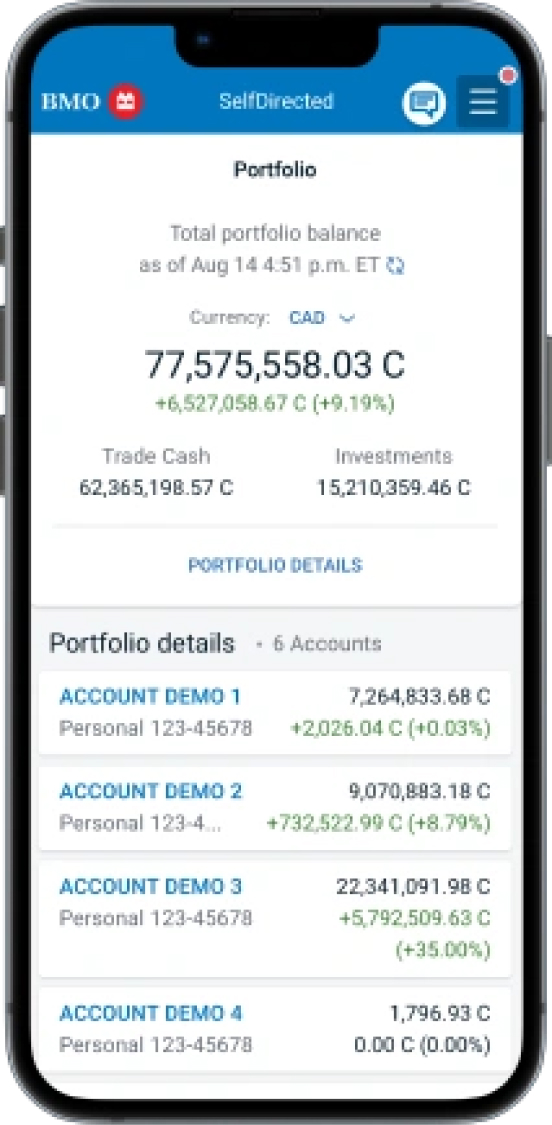

Invest on the go with the new BMO Invest App

Log-in to your Self-Directed accounts wherever you are and start trading now

Buy and sell some of Canada’s most popular Exchange traded fundsfor free

Trade across the major North American exchanges with confidence and ease

Note: The BMO Invest app is designed for mobile phones. For the best BMO InvestorLine experience on tablets please use the latest version of your web browser. Supported browsers include Chrome, Edge, Firefox and Safari.

Want to learn more about online investing?

Still curious about investing?

InvestorLine Self-DirectedFrequently asked questions

Whether you’re a beginner or an experienced investor, Self-Directed gives you the control to manage your own investments. If you’re an active trader, you might want to consider the 5 Star Program.

Each trade of stocks and Exchange traded funds you make online with Self-Directed comes with a flat fee of $9.95. Trading options comes with an additional fee of $1.25 per contract, plus the flat-fee.

Additional fees for trading mutual funds, bonds, GICs, gold and silver can be found in the commission & fee schedule PDF

Self-Directed TFSA accounts do not have account fees. There are also no account fees for registered accounts with a balance of over $25,000 and for non-registered accounts with a balance of over $15,000.

There is no minimum balance to open a Self-Directed account, just collect the required documents and you can start your application today.

Opening an account is simple–you can complete an online application here, open an account in a branch, or over the phone. Don’t forget to get your documents in order before you start.

You must submit an Authorization to Transfer form. By signing into your account, select Move Money from the top menu bar, our site will guide you on whether your transfer request is eligible for electronic submission or if a manual form is required.

For any additional questions, you can visit our frequently asked questions page.