Checking Accounts

Our checking accounts help you make real financial progress. Enjoy a better banking experience with our simple digital banking tools, nationwide fee-free ATM transactions and personalized service—however you choose to bank.

What is a checking account?

A checking account is a type of bank account where you can deposit money and maintain day-to-day expenses like groceries, meals, gas and other necessities. Most checking accounts are tied to debit cards and checks to help you make both small and large purchases. Checking accounts can also help you pay bills online and send money via Zelle®.

Let's find the right checking account for you

We offer a variety of checking accounts, so you’re sure to find one that suits your needs.

No monthly maintenance fee, no minimum balance footnote 1

Unlimited transactions at 40,000+ ATMs nationwide

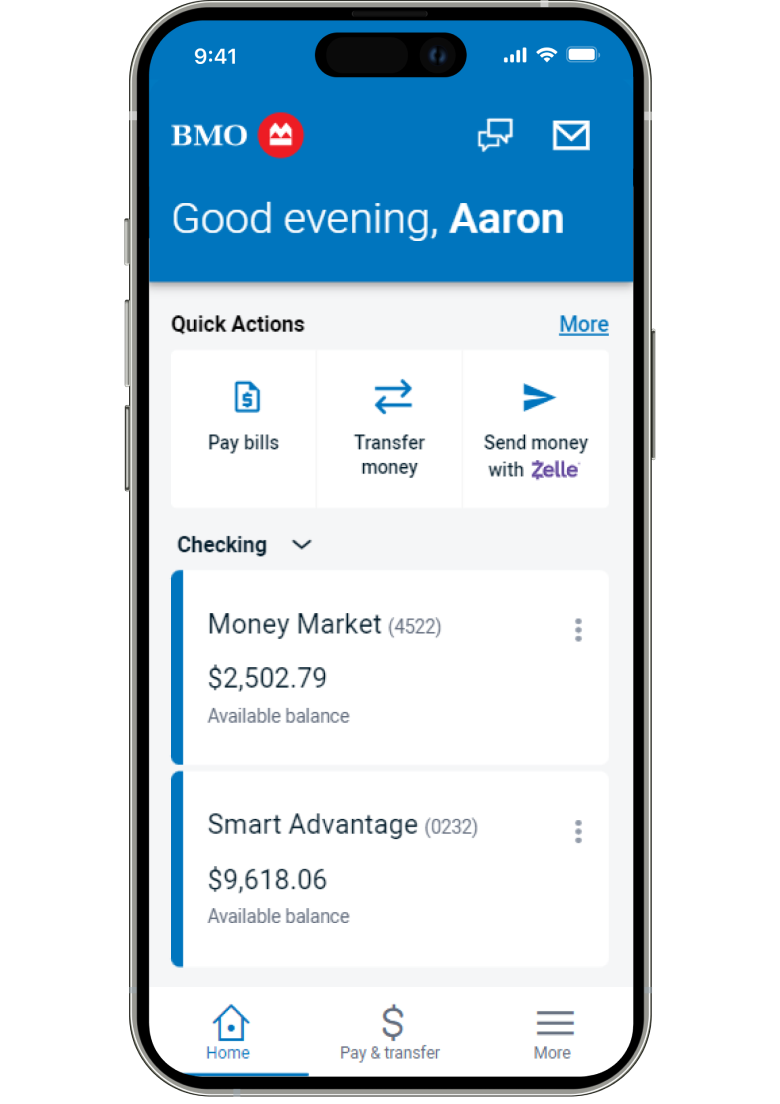

Banking at your fingertips with BMO Digital Banking – pay your bills footnote 2, transfer money and more

Personalized support through online chat, phone and in branch

Open online in 5 minutes!

$5 monthly maintenance fee

$0 if you're under age 25

$0 overdraft fees footnote 3

Unlimited transactions at 40,000+ ATMs nationwide

Banking at your fingertips with BMO Digital Banking – pay your bills footnote 2, transfer money and more

Personalized support through online chat, phone and in branch

Open online in 5 minutes!

$25 monthly maintenance fee

or waive this fee - learn how

Relationship Packages that offer more benefits the more you bank with BMO

4 Unlimited non-BMO ATM transactions footnote 5 and surcharge fee rebates

Access to Mastercard ID Theft Protection™ on your BMO Debit Mastercard® footnote 6

Interest on your checking balance

Security however you bank footnote 7

Whether you bank via mobile footnote 2, online or telephone, all your banking methods are convenient and secure. footnote 7 Our financial crimes unit combines world-class expertise from cyber security, fraud, physical security and crisis management teams. We work to detect, prevent, respond to and recover from security threats.

We make digital banking simple and safe

Bank safely from anywhere with our simple online and mobile banking tools footnote 2.

- Transfer money on the go with Zelle®Footnote 7

Send, request and receive money from friends and family quickly and easily with Zelle® – all with no user fees from us.

- Bank from anywhere with mobile check deposit footnote 9

Skip the trip to the bank and deposit checks directly from your smartphone with mobile deposits.

- Manage all your accounts securelyFootnote 5

Simplify your banking with BMO Total Look. Manage all your accounts in one place (even if they’re not with us), create budgets and track expenses.

Checking accountsFrequently Asked Questions

Checking accounts are used to carry out your daily expenses and keep your money secure. They give you quick access to your funds. Here are some common uses for checking accounts:

Paying by debit for regular purchases, like groceries, gas and takeout

Paying your bills, including utilities, phone and rent

Receiving direct deposits, including your paycheck

Paying off your credit card balance

Opening a new account online is quick and easy. All you need is:

- Your phone number, email address and U.S. residential address

- Your date of birth and Social Security Number (SSN)

- U.S. citizenship (if you aren’t a U.S. citizen, don’t worry – you can apply by phone or in person at a BMO branch)

- A routing and account number so that you can start adding money to your checking account

You can open a checking account online in just a few minutes, which saves you the time spent traveling to a branch. Here are the steps you’ll need to take to open a new account online:

- Choose the account that’s right for you: Compare checking accounts and choose one that suits your needs.

- Submit your online application: Fill out your online application, including your contact information, personal details and employment status.

- Wait for confirmation: We’ll review your application, verify your identity and reach out to you when we’ve opened your new checking account. Then, we’ll send you your new debit card and account info by mail. The full process usually takes a few business days.

- Fund your account and get banking: Once you deposit your opening balance, you’ll be all set to make purchases, pay bills and get paid through your new checking account!

If you’re opening an account online, the application process takes less than five minutes. We’ll then verify your information and send you your new debit card by mail within a few business days.

If you prefer to open a checking account in person at a branch, the application process should take about 30 minutes. You’ll receive your debit card on the spot, so you can start using your account right away!

Switching to a BMO checking account is easy – you can make the change in three simple steps:

- Set up direct deposit so your paychecks and other regular payments go directly to your new account.

- Transfer your automatic payments over to your new account, so you don’t miss a bill payment.

- Close your old account We’ll review your application, verify your identity and reach out to you when we’ve opened your new checking account. Then, we’ll send you your new debit card and account info by mail. The full process usually takes a few business days.

Looking for a detailed rundown of making the switch to BMO? Check out our Switch Kit

Explore our resources for checking accounts

What is a checking account?

Checking accounts are used for a wide range of transactions and can help you manage your income and expenses. Find out what you should know.

8 key advantages of checking accounts to know

How can a checking account help meet your financial needs? Let us count the ways.

Checking vs. savings accounts: what you should know

Learn more about these products and how they can help you reach your goals.

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

Mastercard and Mastercard ID Theft Protection, and the circles design are registered trademarks of Mastercard International Incorporated.

1Accounts with zero balance may be closed.2Message and data rates may apply. Contact your wireless carrier for details.

3Items that overdraw the account are returned and ATM/everyday debit card transactions are declined.

4To access the benefits in a particular Relationship Package, you must have a BMO Relationship Checking account. See the Deposit Account Disclosure for details.

5A Non-BMO ATM Transaction is any transaction conducted at a Non-BMO ATM, including, for example, a withdrawal, transfer, or balance inquiry. No BMO fee; however, the ATM owner or operator may charge you a surcharge fee for a withdrawal, transfer, or balance inquiry.

6Certain terms, conditions, and exclusions apply. For complete coverage terms and conditions call 1-800-MASTERCARD (1-800-627-8372) for assistance. Refer to the Mastercard Guide to Benefits for more information.

7Visit the BMO Security Center for details.

8U.S. checking or savings account required to use Zelle®At BMO we require you enroll a checking account to use Zelle®. Transactions between enrolled users typically occur in minutes when the recipient’s email address or U.S. mobile number is already enrolled with Zelle®. Zelle® should only be used to send money to people and businesses you trust. Zelle® does not offer protection for authorized payments, so money you send may not be recoverable. For details, see the BMO Digital Banking Agreement found at bmo.com/en-us/legal.

9U.S. checking or savings account required to use Zelle®Mobile Deposit is available using the BMO Digital Banking Mobile App. This service may not function on older devices. Users must be a BMO Digital Banking customer with a BMO account opened for more than 5 calendar days. Deposits are not immediately available for withdrawal. For details, please see the BMO Digital Banking Agreement found at bmo.com/en-us/legal.