BMO Relationship Checking

Make the most of your money and get more rewards as your relationship grows with us. Open a Relationship Checking account and make real financial progress.

- Unlimited transactions

Enjoy unlimited transactions at 40,000+ ATMs nationwide and at non-BMO ATMs footnote 1

- Security however you bank

Whether you bank via mobileFootnote 2, online or telephone, all your banking methods are convenient and secureFootnote 3

- $25 or $0

Waivable $25 monthly maintenance fee

Get a full breakdown of the account fees, terms and agreements

Enjoy our Relationship Checking benefits

The more you bank, the more you get with BMO Relationship Checking–Relationship Packages footnote 4. The Relationship Silver package provides all the great benefits of the Relationship Checking account and a Relationship Package benefit.

Want to see all the benefits of Silver?

Build your balances to get even more benefits

Get more benefits the more you save across all your Eligible Deposit Accounts & Eligible Investment Balances. We’ll automatically place you in one of our four Relationship Packages based on your total balances. footnote 4 And when you reach a new level, we’ll adjust your rewards automatically, too.

Want to see all the benefits of Relationship Checking?

Reward yourself – Open an account online in minutes

Earn interest on your Relationship Checking account

Check out your rate!

| Minimum balance to get Annual Percentage Yield (APY)footnote 10 | Interest rate (%) | APY (%)footnote 10 |

|---|---|---|

| $0.01 to $4,999.99 | X.X% | X.X% |

| $5,000.00 to $9,999.99 | X.X% | X.X% |

| $10,000.00 or more | X.X% | X.X% |

BMO Relationship CheckingFrequently Asked Questions

We automatically place your account in the silver, gold, platinum or premier Relationship Package based on your Quarterly Combined Balance across all your Eligible Deposit Accounts and Eligible Investment Balances. The tiers start with silver and move up to premier.

You can open a Relationship Checking account with as little as $25.

The monthly maintenance fee for the Relationship Checking account is $25. But we’ll waive the fee if you meet any of the following requirements:

- The minimum daily Ledger Balance in your account is $10,000 or more for the previous calendar month.

- You have a Monthly Combined Balance of $25,000 for the previous calendar month.

- You’re a client of our employee benefits program, Best of BMO U.S., and have requested the waiver from your BMO Banker.

To get the benefits of our tiered Relationship Packages, you just need a BMO Relationship Checking account footnote 4. We’ll automatically place you in a package based on your Quarterly Combined Balance across your Eligible Deposit Accounts and Eligible Investment Balances.

You’ll have the opportunity to move to a different tier every calendar quarter. Your Relationship Package may change on the first day of each calendar quarter (January 1, April 1, July 1, and October 1) when the Quarterly Combined Balance is recalculated for quarterly placement footnote 4.

If you change your account type or close your account, your fee rebates and interest rate increases may be affected. Here’s what you need to know:

For Relationship Checking account fee rebates:

- Account type changes: If you change your account type and a fee was assessed while the account was a Relationship Checking account, you’ll still get a rebate.

- Closed accounts: If you close your account and a fee was assessed while the account was a Relationship Checking account, you will not get a rebate.

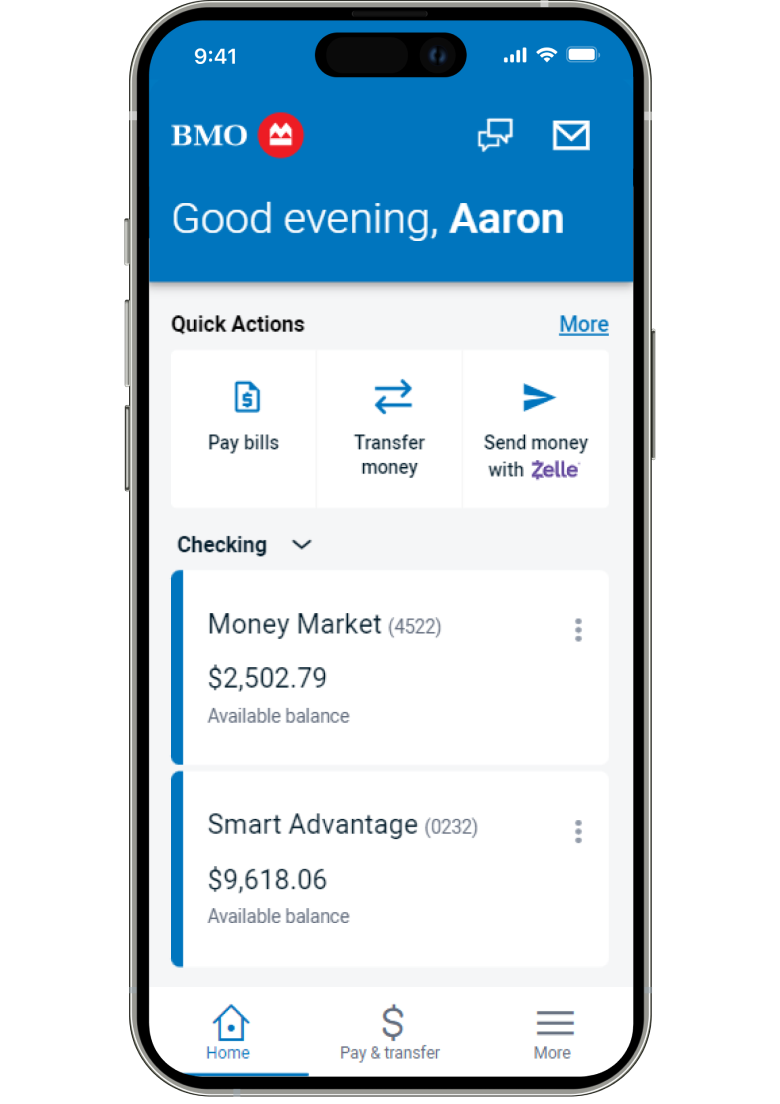

We make banking easy

Manage all your banking needs, whenever and wherever you like. Bank from anywhere with our simple online and mobile footnote 3 tools or find a no-fee ATM close to you.

Over fourty thousandfee-free ATMs across the U.S.

With nearly as many fee-free ATMs across the US as the two largest banks combined, access to your funds is just as convenient as your local ATM footnote 11

Transfer money from anywhere, the fast way

Send, request and receive money from friends and family with Zelle® footnote 12–all with no user fees from us.

Account protection for added peace of mind

Bank with confidence knowing your deposits are FDIC insured and you’re protected by our Digital Banking Guarantee footnote 13

Explore our resources for checking accounts

Mastercard and Mastercard ID Theft Protection™ and the circles design are registered trademarks of Mastercard International Incorporated.

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

1 No BMO ATM Transaction Fee; however, the ATM owner or operator may charge you a surcharge fee for a withdrawal, transfer, or balance inquiry

2 Message and data rates may apply. Contact your wireless carrier for details.

3 Visit the BMO Security Center for details.

4 To access the benefits in a particular Relationship Package, you must have a BMO Relationship Checking account. See the Deposit Account Disclosure for details.

5 Certain terms, conditions and exclusions apply. For complete coverage terms and conditions call 1-800-MASTERCARD (1-800-627-8372) for assistance. Refer to the Mastercard Guide to Benefits for more information.

- Footnote 6 details See the Full Benefits Tablefor details.

- Footnote 7 detailsAuto Pay means periodic scheduled payments automatically deducted from your BMO personal checking account, as applicable, to pay the loan. When you sign up for Auto Pay, you authorize the Bank to draw your account for all amounts then due, including any late fees and any other charges. To receive a 0.125% rate discount, you must authorize BMO at origination to withdraw your loan payment each month from your BMO consumer checking account. Housing Finance Agency, FHA, VA, and State Bond Program loans are not eligible for the interest rate discount but will receive a $500 closing cost discount if eligible. Footnote 8 detailsAuto Pay means periodic scheduled payments automatically deducted from your BMO personal checking account, as applicable, to pay the loan. When you sign up for Auto Pay, you authorize the Bank to draw your account for all amounts then due, including any late fees and any other charges. To receive a 0.25% rate discount, you must authorize BMO at origination to withdraw your Home Equity Line of Credit or Home Equity Loan payment each month from a BMO personal checking account using Auto Pay. The discount can only be applied to a new Home Equity Loan or a new Home Equity Line of Credit.9Relationship Plus Money Market is no longer for sale as of May 4, 2025. The terms below will still apply for customers who have a BMO Relationship Checking Account and already have an existing Relationship Plus Money Market Account. We may offer higher variable interest rates based on a Relationship Package. For current interest rates, ask your BMO Banker for a current Interest Rate Sheet or call call us at 1 8 8 8 7 7 9 2 2 6 5. Interest rates earned on the Relationship Plus Money Market are based on Relationship Package placement. If the Account Owners’ BMO Relationship Checking Accounts are placed in different Relationship Packages, the best Relationship Package will determine the interest rates earned on the Relationship Plus Money Market Account. Initially, the Relationship Plus Money Market Account earns standard interest rates. The Relationship Plus Money Market Account earns Relationship Package interest rates beginning on the first Business Day of the month after the Account opening (or the Account type change) occurs through the end of the calendar quarter. At each Quarterly Placement, the Relationship Plus Money Market Account earns Relationship Package interest rates beginning on the first Business Day of the calendar quarter through the end of the calendar quarter.

Footnote 10 detailsAll Interest Rates and Annual Percentage Yields (APY) are accurate as of the effective date shown above. For variable rate accounts interest rates and APYs may change after the account is opened. At our discretion we may change the interest rate on these accounts daily. For accounts that have more than one tier, the interest rate corresponding to the highest tier into which the collected balance falls will be paid on the entire collected balance. Interest rates and APYs offered within two or more consecutive tiers may be the same. In this case, multiple tiers will be shown as a single tier. Fees or withdrawals will reduce earnings. These rates apply to our Illinois and Northwest Indiana locations, excluding locations in South Beloit, Roscoe and St. Clair County in Illinois. Footnote 11 detailsForeign Transaction Fees will apply at BMO and Allpoint® ATMs located outside of the United States.

Footnote 12 detailsMust have a bank account in the U.S. to use Zelle. Transactions typically occur in minutes when the recipient’s email address or U.S. mobile number is already enrolled with Zelle. For details see the BMO Digital Banking Agreement found at bmo.com/en-us/legal/

Footnote 13 detailsCertain conditions and limitations apply. The Digital Banking Guarantee applies to personal accounts. Please see the BMO Digital Banking Agreement found at bmo.com/en-us/legal/ for details.