Margin Accounts

Maximize your buying power and obtain additional funds by borrowing against the value of your investments within your BMO InvestorLine Self-Directed or adviceDirect Margin account.

Potential to increase your returns and improve your portfolio diversification

Access funds from your margin account at a low interest rate

Ability to add short selling and options to your investment strategy

What are the benefits of having a margin account?

Margin accounts allow you to take advantage of market opportunities and potentially increase your investment returns. With a margin account, you can borrow against your investments, giving your trades greater buying power to go long or short. It is important to note that while it can potentially lead to higher returns, it can also elevate the potential for higher losses.

With our online trading platforms, you can make intraday margin trades using real-time buying power calculations, allowing you to optimize your trades for price movements.

Margin rates vary based on the type of financial product and maturity date. Learn more about our Margin Rates.

| Margin Accounts | Cash Accounts |

|---|---|---|

Types of investments: stocks, mutual funds, ETFs, fixed income | ✓ | ✓ |

Borrowing against securities | ✓ |

|

Options footnote star | ✓ |

|

Short selling footnote star | ✓ |

|

footnote star detailsBMO InvestorLine Self-Directed accounts.

Explore BMO InvestorLine’s margin trading capabilities

Ready to start investing?

Online trading

$0 minimum account size

A great choice if: You want to be in control of the entire investment process, from research and trading to track your portfolio’s progress.

Price: $9.95 per equity trade

Online trading with advice

$10,000 minimum account size

A great choice if: You want to trade yourself, with advisor support and built-in guidance backed by expert analysis to help you decide what to do.

Price: Advisory fees as low as 0.10% of billable assets for portfolios $5MM or greater.

Understanding Margin Trading: An investor's Guide

Everything you need to know about Margin Trading and its benefits.

Margin Account FAQs

The interest rate charged depends on the margin amount and current interest rate amount. Interest is calculated daily. You can see the updated rates here.

You can read our detailed guide on margin trading in the Investment Learning Centre.

Margin rates vary based on maturity date and type of financial product. Review our BMO InvestorLine Margin Rates.

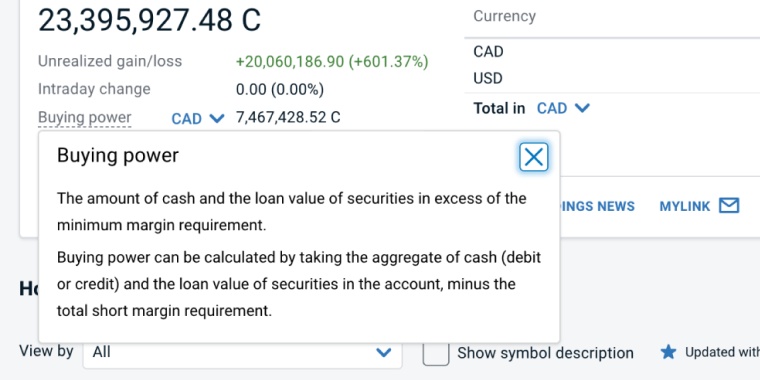

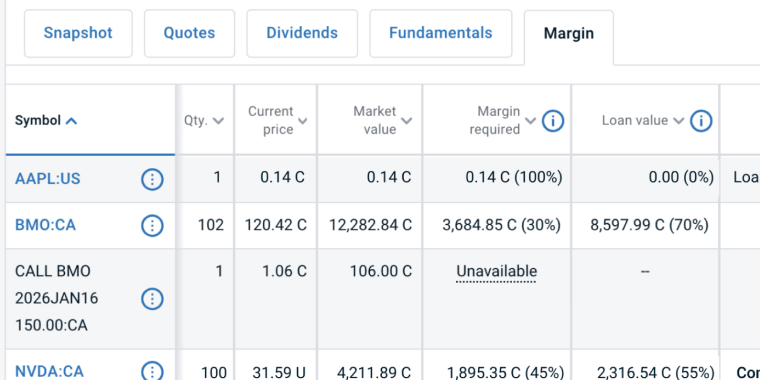

You can view your holdings’ margin rates and loan values on our platform’s “Holdings” screen. Click on the “Margin” tab to see this information including any special conditions set for specific securities. This tab will also show any concentrated positions.

Yes, our system offers a real-time buying power calculation that factors—within seconds— real time market prices, order fills, money movement request through “Move Money” and any special loan conditions for your securities. The buying power displayed on our website uses a similar calculation but updated every five minutes.

BMO InvestorLine calculates concentration every five minutes during trading hours. A security is considered concentrated when the following criteria are met:

- The credit exposure of the account is at least $250,000. Credit exposure is the net cash debit plus the margin requirement for short positions. If you have no short positions in your account then the credit exposure is simply the net cash debit.

- The loan value of the security is over 25% of the overall loan value of the portfolio of the account.

You can see which securities in your account are concentrated on the margin holdings tab.