Manage my BMO account

Congrats on opening your BMO bank account! Now, let’s get you set up so you can take care of your everyday banking faster and more conveniently.

Tips for quicker, easier banking

Set up your eStatements (online statements)

With e Statements, you can securely view, print and save your BMO account statements (e.g. chequing, savings, credit card, line of credit, mutual funds) online. e Statements have the same look and details of paper statements, and are stored for seven years.

Set up a direct deposit

Save yourself a trip to the bank or ATM and get immediate access to your money with direct deposit. Have your pay, dividends, Canada Revenue Agency (CRA) and other government payments automatically added into your account.

Learn how to set up CRA direct deposits.

Learn how to set up other direct deposits on our Ways to Bank page.

Set up a recurring payment

Never miss a payment when you arrange to pay bills on a recurring basis from your bank account, credit card or line of credit.

In online banking: Sign in to BMO Online Banking go to the Move money tab and select Bill payments. Then follow the Make a Payment process and select the Frequency of the recurring payment.

Try the ongoing bill payment demo.

In mobile app: Open the mobile app and follow the Pay a Bill process. Select the payment date and the frequency of payments.

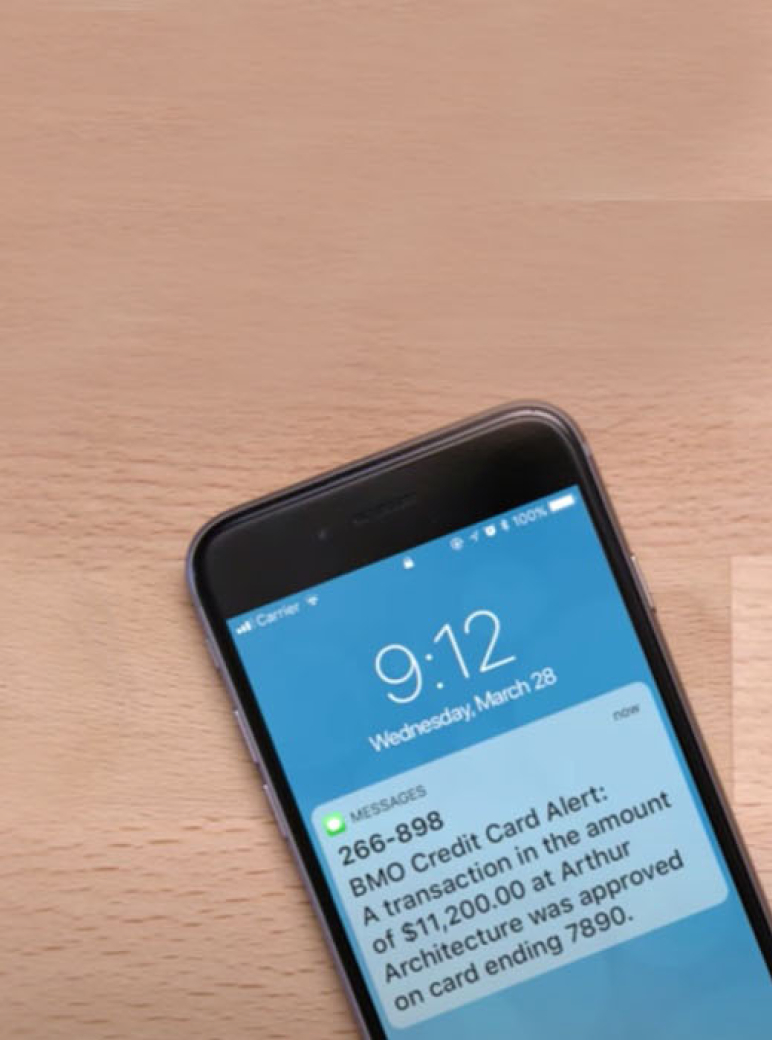

Stay in the loop with BMO Alerts

Set up and customize BMO Alerts and get notifications when your account reaches a minimum balance, if large deposits or withdrawals happen, or if there’s any suspicious activity on your account. Learn more about BMO Alerts.

Set up your mobile wallet

Add your BMO debit card to Apple Pay or Google Pay and enjoy the security and convenience of paying right from your phone.

Feel secure with overdraft protection

Adding overdraft protection to a bank account is a simple way to cover unexpected shortfalls and avoid the risk of a declined transaction or cost of a returned cheque.

Visit your local branch set up the best overdraft protection option for you20.

Manage my account F A Qs

It’s easy to get started with BMO Online Banking. You just need your BMO debit card. Once you’re signed up, you can check your account, pay bills, transfer funds and more from your laptop or phone. Check out this Get Started Online demo.

Conveniently bank wherever you are with the BMO Mobile Banking app.

Once you're registered for online banking, download the app and sign in with your digital banking credentials. You’ll find your account balance once you sign in.

If you’ve opened other chequing or savings accounts linked to your lead chequing account, you’ll find them listed in your online banking or mobile banking app, under the My Accounts tab.

Whether you’re setting up direct deposit or depositing cash or cheques, you can direct which chequing or savings account you’d like it to go into, either by providing the account number (for direct deposit) or selecting the appropriate account (cash/cheque deposits).

The same goes for setting up recurring payments. Just indicate which account you want the money to come out of, and we take care of the rest.

You can also instantly transfer funds between your different BMO accounts using online banking, mobile banking or a BMO ATM.

Visit our Ways to Bank page to discover tips on making everyday banking easier and find handy digital tools.

Advice on how to make the most of your money

Apple, the Apple Logo, Apple Pay, iPhone, Apple Watch and Touch ID are trademarks of Apple Inc., registered in the U.S. and other countries. iOS is trademark or registered trademark of Cisco in the U.S. and other countries.

™ Google Pay and the Google Pay Logo are trademarks of Google L L C.