BMO Alerts

Get text, email or app notifications about what’s going on with your credit card, bank accounts, or lines of credit. Choose and customize your alerts so you get just the info you want.

Always stay in the loop

We send alerts to keep you informed of activity in your account, including suspicious activity. BMO Alerts are split into 3 categories: bank account, credit card and line of credit.

How to set up your BMO Alerts

Setting up your BMO Alerts is simple and fast. Here’s how to get started in three easy steps.

BMO Alerts F A Qs

You can choose to get your alerts by email, text message or BMO Mobile Banking app notification.

- Sure thing! Sign in to BMO Online Banking and go to “Profile & settings” and select “Alerts preferences”, or sign in to BMO Mobile Banking and select “Alerts” from the “More” menu. You can then change your Alerts as you like.If you change your mobile phone number, you’ll need to verify it and reply “Yes” to the verification text we send shortly after you enter the update. The verification can be completed on the Alert preferences page in BMO Online Banking or your Alerts Contact Info page in BMO Mobile Banking.

Sign in to BMO Online Banking and go to "Profile & settings" to update your contact information. If you change your mobile phone number, you’ll need to reply ‘Yes’ to the verification text we send shortly after the update.

Of course. You can opt out of BMO Alerts at any time by signing into BMO Online Banking or BMO Mobile Banking and modifying your Alert settings, or by texting “STOP” to 266898.

Absolutely. We’ll never send your entire account number, password or other personal identification information in an alert message. And we’ll never ask you to send personal information like your address, account number or password by text message or email. If you get an alert asking for personal information that appears to be from BMO, please do not respond and instead, help us protect you from fraud by letting us know.

- First, be sure to confirm your Alert preferences in BMO Online Banking or BMO Mobile Banking. If you’re still not getting them, try the following:

- Confirm your contact info.

- If you’ve selected email, make sure the Alerts aren’t going to your junk mail folder.

- If your chosen contact method is SMS or text, make sure your device settings allow you to receive text messages.

- Ensure that your Alerts haven’t been ‘turned off’ in your Alert preferences page in BMO Online Banking or your Manage Alerts page in BMO Mobile Banking.

- Ensure that the email address or mobile number are enabled in your Alert Preferences page in BMO Online Banking or your Alerts Contact Info page in BMO Mobile Banking.

- If you’ve selected to receive BMO Alerts as an app notification, make sure you’ve allowed notifications for the BMO Mobile Banking App in your device settings and in the Alert settings after you’ve signed in to the BMO Mobile Banking App.

If you’re still having trouble, contact us and we’ll be happy to help. - Some alerts are sent automatically to help you stay on top of your banking. But we don’t mean to bother you – if you feel you’re getting too many messages, you can modify your Alert settings by signing into BMO Online Banking or BMO Mobile Banking.To learn more about the account balance alert or the approaching limit alerts go to www.bmo.com/info.

BMO Alerts is a free service, however you’re responsible for any fees charged by your mobile device service provider including standard messaging and data charges.

- Security Alerts: Get notified about any suspicious activity on your credit card. You can confirm you made a specific transaction or immediately report it as fraudulent.Authorized Transaction: Get an alert when a transaction is made above a specific amount. (e.g. I want to receive an alert anytime a purchase over $100 is made on my BMO credit card).Declined Transaction: Get an alert when a transaction is attempted but declined. We’ll let you know the amount of the transaction, the merchant and the reason why it was declined.Approaching Credit Limit: Get an alert if a transaction puts you close to your credit limit. Set the amount you want to be notified at, for example when you’re within $250 of your credit limit.Minimum Payment Due: Set a reminder alert between 1 to 10 days before your minimum payment is due.Posted Payment: Get confirmation when a payment is posted to your account.

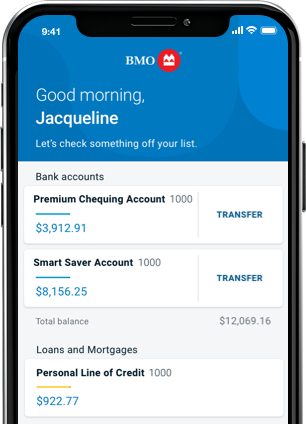

- Account Balance: Know when your account balance drops below a set amount.Large Withdrawals: Get an alert when a withdrawal above a certain amount is made from your account.Large Deposits: Get an alert when a deposit above a certain amount is made to your account.eStatement: Know when your eStatement is ready for viewing.Security Alerts: Be notified if there’s any unusual activity on your BMO debit card and if you need to change your PIN or come into a branch.

- Approaching Credit Limit: Get an alert if a transaction puts you close to your credit limit. Set the amount you want to be notified at, for example when you’re within $250 of your credit limit.eStatement: Know when your eStatement is ready for viewing.Transaction alerts: Get alerts to your mobile number or email for withdrawal transactions, such as bill payments, transfers, and cheque payments, made from your line of credit based on your minimum transaction amount selected.

- When you receive a BMO Alert on your mobile device via SMS, it will come from our 6 - digit code 266898. Our code never changes, so this is how you’ll know we’re messaging you.You might receive alerts from us if we detect suspicious activity on your bank account or on your credit card. You’ll have the option to reply “Y” on transactions that you recognize are yours. If you reply "Y", there will be no need for any further action.If you reply with “N”, you’ll receive a follow up text-message notifying you that your card is restricted, in this case please call BMO at 1-800-263-2263 for further details and next steps.

App notifications are personalized messages sent directly to your mobile device. In order to get your BMO Alerts as an app notification, sign in to BMO Mobile Banking and select “Alerts” from the “More” menu. From there, you can turn on app notifications for BMO Alerts. You also need to make sure that you allow notifications for the BMO Mobile Banking App in your device settings.

Your alert information may be displayed in the push notification previews when your screen is locked. If you want to view push notifications only when your screen is unlocked, go to your device’s notification settings for the BMO app.

You can only enable app notifications for BMO Alerts on one device. If you enable them on a second device, they’ll be disabled on the first device. This means:

- If you get a new device – enable app notifications on your new device and they’ll be disabled on the old device.

- If you lose your device – enable app notifications on a new device to disable them on your old device. Or sign in to BMO Online Banking and go to “Alerts preferences” in the “Profile & settings” tab to disable app notifications on each alert.

We don’t recommend using app notifications on shared devices because:

- If you sign in to a mobile device that’s not your primary device, your alerts may be sent to the shared device.

- If the other user changes their notifications preferences while using your device, they may affect or cancel your existing notification preferences and their alerts could be sent to your device.

Please note BMO Alerts can be delivered by text message (SMS) through major Canadian wireless providers and sent from the short code 266898. You can use BMO Alerts at no additional cost from BMO. However, you are responsible for all fees charged by your mobile device service provider including standard messaging and data charges. Message frequency depends on your account settings. You can opt-out of BMO Alerts at any time by modifying your alert settings or by texting "STOP" to the short code 266898.