BMO eclipse Visa Infinite Privilegefootnote starCard

Make every moment more rewarding with extra earning power and perks.

Minimum $150,000 (individual) or $200,000 (household) annual income required.

Make every day 5x more rewarding

Earn more (a lot more) on your daily needs and wants.

Groceries

Give every recipe the 5-star treatment with 5x the points on groceries. Bon appétit!53

Dining in and out

You’ve got great taste! Earn 5x the points on fine dining, Friday night drinks and takeout.53

Gas

Make long-weekend traffic in cottage country a little more bearable with 5x the points on gas.53

Drugstore

Elevate your everyday errands with 5x the points on healthcare, beauty and other drugstore purchases.53

Travel

Let the journey be as rewarding as the destination with 5x the points on travel.53

Plus, earn 1 point for every $1 spent on everything else56 – you deserve it.

Minimum $150,000 (individual) or $200,000 (household) annual income required.

Your Visa Infinite Privilege benefits

Enjoy a Visa Airport Companion membership and 6 complimentary airport lounge visits per year – valued at more than $250 USD. Enrollment is required. Enroll at visaairportcompanion.ca or through the Visa Airport Companion App.57

Get Priority Security Lane, airport parking and valet service discounts at select Canadian airports.58

Access the Visa Infinite Luxury Hotel Collection with exclusive benefits (like free breakfast).59

Connect to the Visa Infinite Privilege Concierge - it’s like having a personal assistant on call!60

Enjoy unique dining and wine events with Visa Infinite Dining Series61 and Visa Infinite Wine Country.62

Get the Troon Rewards® Golf benefits like discounts at over 95 resorts and courses around the world plus access to select private clubs across the U.S.63

Already a cardholder? Visit visa.ca/infiniteprivilege to find a full list of available benefits. Enroll to get emails and to be the first to know about exclusive offers and experiences.

BMO Rewards calculator

Estimate your monthly spending

Groceries, dining, drugstore, gas and travel (earn 5x the points for every $1 spent):

All other purchases (earn 1 point for every $1 spent):

0

2,400 points for lattes for you and a friend

12,600 points for a monthly gym membership

16,800 points for a spa treatment

BMO eclipse Visa Infinite Privilegefootnote star Card

Ready to make every moment an eclipse moment? Here’s what you need to know:

ERROR API VALUE NOT FOUND

annual fee8

ERROR API VALUE NOT FOUND

for purchases8

ERROR API VALUE NOT FOUND

for cash advances8

Minimum $150,000 (individual) or $200,000 (household) annual income required.

Travel with our suite of travel insurance coverages, including:

Out-of-Province/Country Emergency Medical Insurance

Common Carrier Insurance

Car Rental Collision/Loss Damage Insurance

Trip Cancellation/Trip Interruption Insurance

Flight Delay and Baggage Insurance for baggage delay, loss, theft or damage and much more65

Enjoy peace of mind with Mobile Device Insurance, which provides coverage of up to $1,000 in the event your mobile device is lost, stolen or accidentally damaged.65

Stay in control with alerts, our card lock/unlock feature and lost or stolen card reporting.

Get peace of mind with Visa Secure. It safeguards cardholders if there is any monetary loss resulting from fraudulent card use.

Enjoy an additional layer of security on all online purchases with Visa Secure.

BMO PaySmart™ Installment Plans

Live now, pay smarter with a BMO PaySmart plan by turning your credit card purchases into smaller, monthly payments at a low cost.

Ready to apply?

Start celebrating your everyday moments now.

We’ll respond in under 60 seconds.

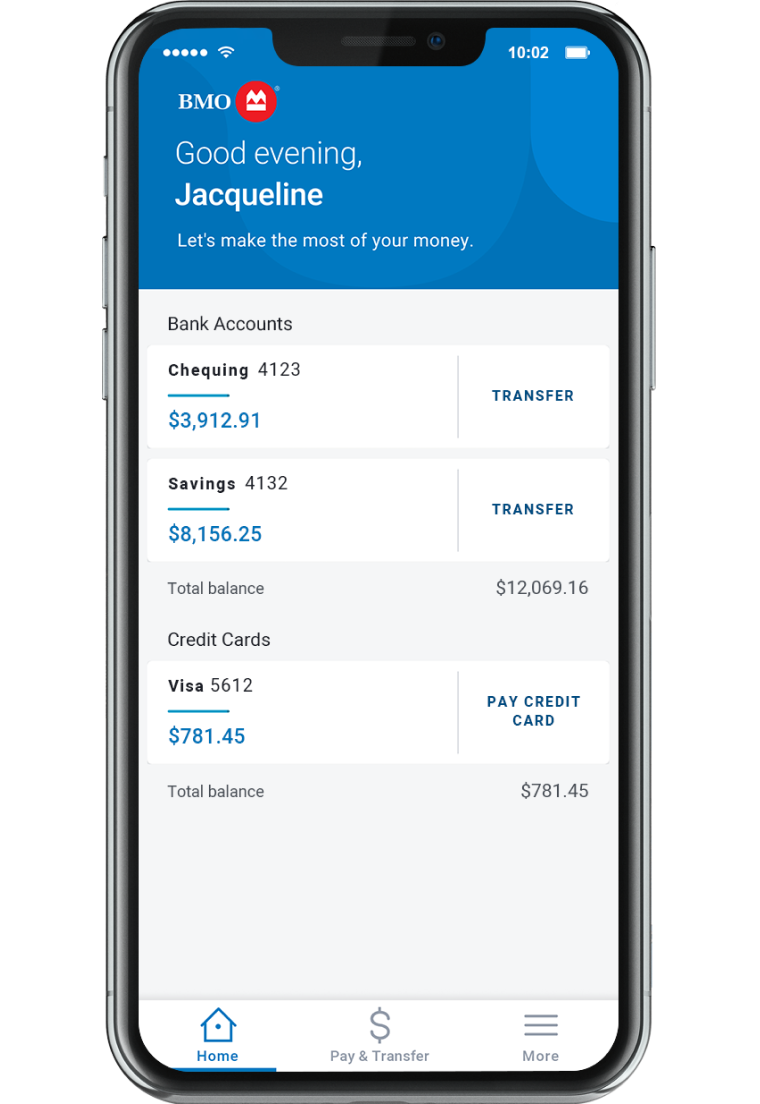

Digital features and security at your fingertips

Give your financial health a boost with online and mobile banking tools. Enjoy more control over your credit card and a better understanding about how you’re using it.

Safety and security

Can’t find your card? No worries, you can lock it, unlock it or report it lost or stolen at any time.

Financial insights

Stay on top of your spending with a personalized look at your money.

Credit score

Get free, 24/7 access to CreditView with no impact to your credit score.

Dispute a transaction and PIN reset

Resolve an issue with your statement or reset your PIN directly from your mobile app.

Frequently Asked Questions

Think of it as getting rewarded just for being you! A lifestyle credit card offers increased points earned on the things you buy the most.

You’ll need to share a few things to open an account online, including your name, date of birth, contact info, SIN, address, employment status, income source(s), rent or mortgage amount, and what you’ll be using the account for.

- Be a permanent Canadian resident

- Have not declared bankruptcy in the past seven years

- Have reached the age of majority in the province in which you live (18 years in AB, MB, ON, PE, QC and SK. 19 years in all other provinces)

- Meet minimum income requirements

For BMO eclipse Visa Infinite Privilegefootnote star cards, your minimum annual income should be $150,000 (individual) or $200,000 (household). If you don't meet the income requirements, you could also qualify if you have $50,000 total spend within the last twelve months on all your other credit cards collectively, a minimum spend of $4,170 per month on application.

Yes. We’re committed to protecting your confidential information and privacy and we continuously employ the latest security software to our sites and apps.

Additionally, our digital experiences have been upgraded with extended validation (EV) SSL Certificates, which add another layer of protection by identifying our sites and applications as legitimate.

When you are sent a new card, a return envelope will also be provided. Activate your new card first, then using the envelope provided, return your old card by dropping it off at any community mailbox.

- Yes, you can! You’ll be able to set up, manage and review your PaySmart installment plans from your Online Banking account.

To get started, simply login and follow these steps for recent eligible credit card purchases of $100 CADCanadian currency or more:

- Choose an eligible credit card purchase you’d like to convert into a PaySmart plan.

- Go to the Installment Plan tab and click the Create button.

- Select the plan that works best for you.

BMO Credit Card Cardholder Agreement

Get PDF for full detailsGet all the details about the benefits that come with your card as well as your rights and responsibilities as an eclipse Visa cardholder.

Certificate of Insurance

Get PDF for full detailsThis guide outlines the terms and conditions governing the insurance that comes with your card.

Insurance Product Summary (For Quebec Residents)

Get PDF for full detailsSummary of the benefits, and key terms and conditions of the insurance that comes with your card.

BMO Rewards Terms and Conditions

Get PDF for full detailsThis guide outlines in detail terms and conditions governing your BMO rewards.

Important information on rates and fees

Get PDF for full detailsKey information about your BMO credit card, such as current fees, interest rates, grace period, minimum payment, foreign currency conversion and more.

Registered sign BMO is a registered trademark of Bank of Montreal.footnote star details Trademark of Visa International Service Association and used under license.