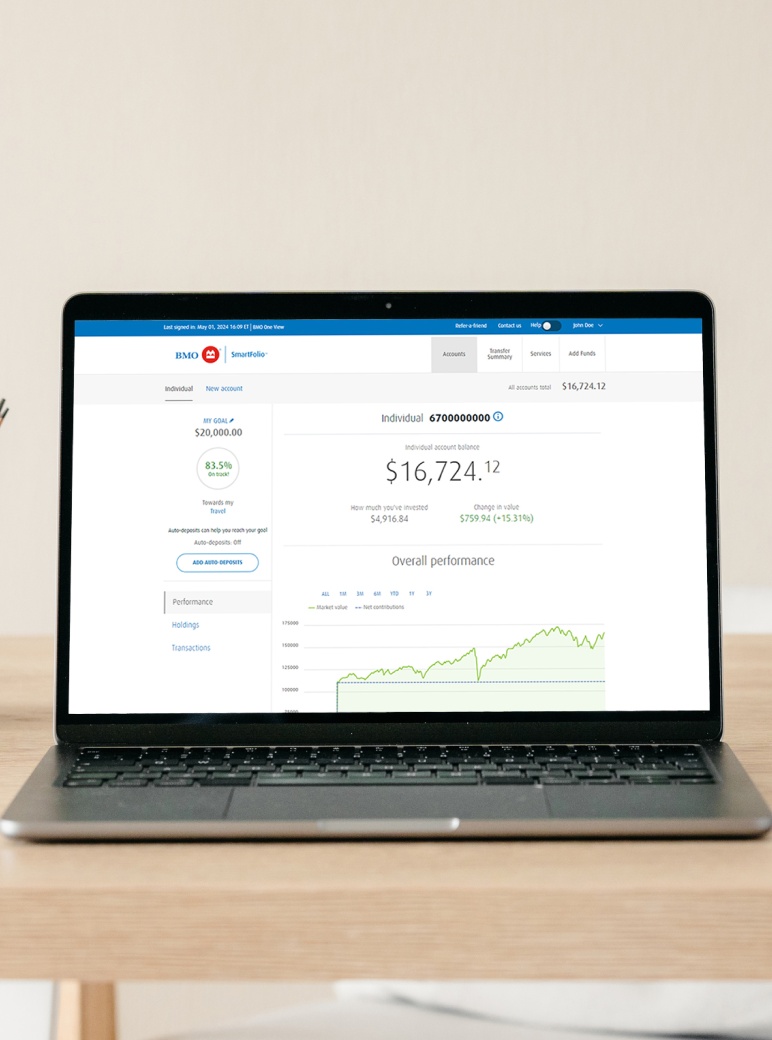

SmartFolio

SmartFolio brings together the convenience of online investing, professional portfolio management and low fees to save you time and money. Think of it as hands-off investing – we do all the heavy lifting, you reap all the rewards.

Dedicated advisors manage your portfolio

Low advisory fees from 0.4 to 0.7%

Total transparency about your performance, fees and progress

What is SmartFolio?

SmartFolio is a digital investing experience that helps you invest online with confidence. The first service of its kind by any bank in Canada, SmartFolio works like a robo-advisor, but with the added benefit of our team of experts to make the calls.

With over 300 years of experience under their belts, you don’t need to be an expert to reach your investing goals – let us handle the hard stuff, and you stick to what you do best.

Accounts available with SmartFolio

- These accounts are registered with the federal government and offer you certain tax incentives. Registered accounts can help with retirement investing, saving for education or a large purchase, and more.Great for: Investing in the future while getting tax incentives.Accounts offered: TFSA, RRSP, RESP, RRIF

- Non-registered accounts don’t offer any tax advantages. They do not have any limits to your contributions, however, so you’re free to contribute and withdraw as much as you want.Great for: People who have maxed out their registered account contribution limits but still want to invest.Accounts offered: Individual, Joint

Why does SmartFolio only invest with ETFs

ETFs give your portfolio diversification while simultaneously reducing trading expenses. This is because the funds allow access to an entire index worth of stocks or bonds with a single ETF purchase. That lets us pass the savings on to you.

SmartFolio FAQs

SmartFolio will charge you an advisory fee on a quarterly basis. Your average annual rate will actually decrease as the assets in your accounts increase – the more you invest, the lower your fees. Learn more about our fees here.

When you sign up for SmartFolio, we’ll ask you a few questions to get to know you, your goals and your risk tolerance. We’ll use this information to match you with a model portfolio for you to review. One of our SmartFolio representatives will review your application to make sure you’re aligned with our plan. Still have questions? Here’s how SmartFolio works.

We understand that, over time, your needs and goals are going to change. Just keep us informed of any big changes that might affect your risk tolerance or your goals, and we’ll make sure your portfolio stays in line with your objectives.

Absolutely! It’s easy to set up pre-authorized contributions from your BMO bank account from the SmartFolio platform.

If you prefer, you can fill out a Pre-Authorized Contribution form to set up weekly, bi-monthly or monthly contributions for any Canadian Financial institution.

We ask that all investments are transferred in cash, which we’ll promptly invest to match your model portfolio. We don’t allow for non-model portfolio holdings to be purchased within your SmartFolio account, but we do have many great offerings that can allow you to transfer your alternative holdings.