BMO eclipse Visa Infinite* Card

Getfive times the points on groceries, gas, takeout and more.67

Minimum $60,000 (individual) or $100,000 (household) annual income required OR minimum $15,000 declared current annual spend.

Make every day a 5x points day

Earn more (a lot more) on your daily needs and wants.

Groceries

Earn 5 points per $1 spent at grocery stores.67

Gas & transit

Earn 5 points per $1 spent on gas, public transit, and rideshare apps like Uber and Lyft.67

Dining out

Earn 5 points per $1 spent on dining out or grabbing drinks at your favorite restaurants, pubs, and cafés.67

Takeout & food delivery

Earn 5 points per $1 spent on takeout or delivery from restaurants and apps like UberEats and DoorDash.67

Plus, earn 1 point for every $1 spent on everything else70 – there’s so much points potential out there.

Minimum $60,000 (individual) or $100,000 (household) annual income requiredORMinimum $15,000 declared current annual spend.

Save on groceries and more with complimentary Instacart+

Enjoy six months of Instacart+ and a $10 monthly Instacart credit when you enroll your eligible BMO Credit Card.120 Terms apply.

Out-of-province/out-of-country emergency medical insurance up to $5 million per insured person, per trip - up to 15 consecutive days. footnote star

Common carrier insurance.

Car rental – collision/loss damage insurance.

footnote star details Please review the BMO Eclipse Visa Infinite Certificate of Insurance for more details.

TOP-UP INSURANCE

Your credit card already includes built-in travel insurance. With BMO Travel Insurance, you can top up your coverage for longer trips and boost your benefits for added protection beyond your existing plan.

Mobile Device InsuranceProvides up to $1,000 of protection against loss, theft or accidental damage of your smartphone, cellular phone or tablet, anywhere in the world if the device is purchased in full with your card or, if financed through a fixed term contract with a Canadian wireless service provider and all recurring wireless bill payments are charged to your card.97

Extended Warranty InsuranceDoubles the original manufacturer’s warranty period on items purchased up to a maximum of one year when you charge the full purchase price to your card.97

Purchase Security InsuranceCovered items purchased in full with your card are automatically insured against theft or damage for the first 90 days from date of purchase.97

Get access to the Visa Infinite Luxury Hotel Collection and enjoy seven exclusive benefits (like complimentary breakfast).59

Make dining even finer with the Visa Infinite Dining Series.61

Connect to the Visa Infinite Concierge - it’s like having a personal assistant on call!71

Get the Visa Infinite Troon Golf Benefit and enjoy discounts at 95 resorts and courses around the world.72

Already a cardholder? Visit visainfinite.ca to find a full list of available benefits. Enroll to get emails and to be the first to know about exclusive offers and experiences.

Visa SecureEnjoy an additional layer of security on all online purchases with Visa Secure. It safeguards cardholders if there is any monetary loss resulting from fraudulent card use.

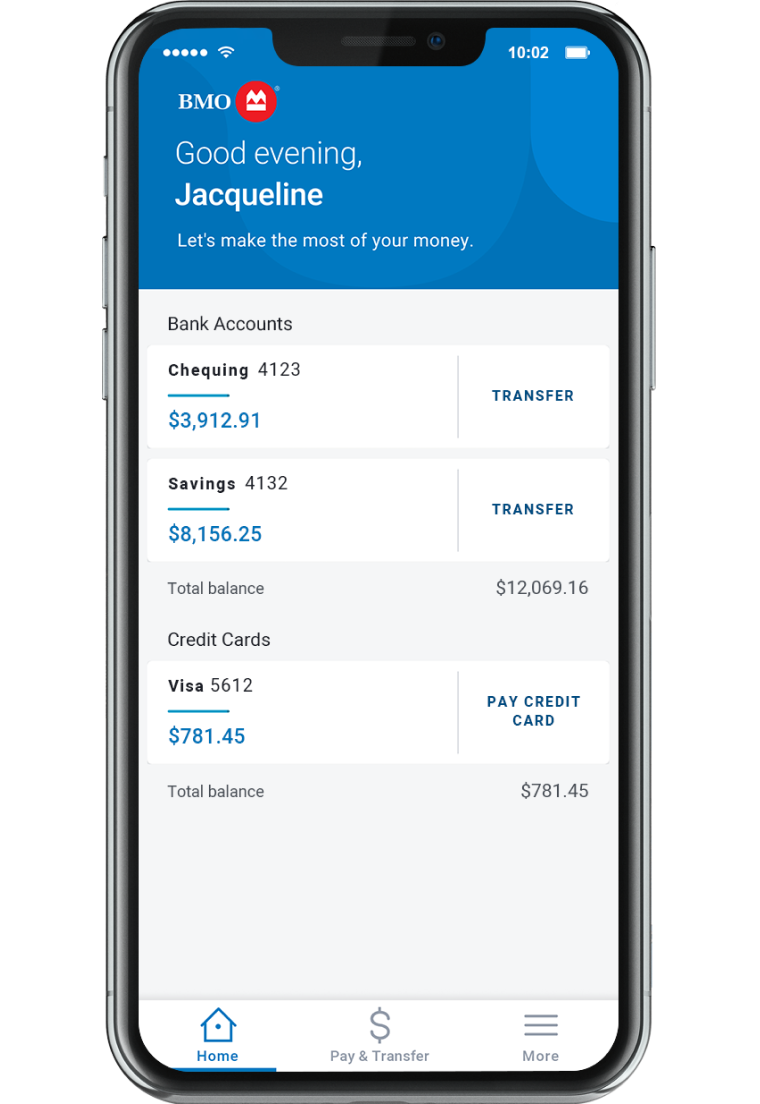

BMO AlertsManage notifications for credit card transactions, large purchases, international use and more via BMO Digital Banking or BMO Mobile Banking.

Card Lock / UnlockYou can lock / unlock your card instantly via BMO Digital Banking or BMO Mobile Banking.

Lost / Stolen ReportingReport your card lost or stolen and request for a new one via BMO Digital Banking or BMO Mobile Banking.

BMO Rewards calculator

Estimate your monthly spending

Dining, groceries, gas and transit (earn 5 times the BMO Rewards points for every $1 spent):

All other purchases (earn 1 point for every $1 spent):

0

2,400 points for lattes for you and a friend

12,600 points for a monthly gym membership

16,800 points for a spa treatment

BMO PaySmart™ Installment Plans

Live now, pay smarter with a BMO PaySmart plan by turning your credit card purchases into smaller, monthly payments at a low cost.

Ready to apply?

Start celebrating your everyday moments now.

We'll respond in under 60 seconds.

Digital features and security at your fingertips

Give your financial health a boost with online and mobile banking tools. Enjoy more control over your credit card and a better understanding about how you’re using it.

Safety and security

Can’t find your card? No worries, you can lock it, unlock it or report it lost or stolen at any time.

Financial insights

Stay on top of your spending with a personalized look at your money.

Credit Score

Get free, 24/7 access to Credit Coach with no impact to your credit score.

Dispute a transaction and PIN reset

Resolve an issue with your statement or reset your PIN directly from your mobile app.

Frequently Asked questions

Think of it as getting rewarded just for being you! A lifestyle credit card offers perks likefive timesthe points on everyday purchases like gas, groceries, transit, dining out and ordering in, and 1 point for everything else. It’s a credit card with the best benefits for making the most of every moment.

You can pay with your Rewards points in 3 simple steps:

- Sign into bmorewards.com and select the “Pay with Points” tab.

- Browse your recent transactions and select which eligible purchase you want to redeem points for.

- Choose how many points you would like to redeem toward your purchase - you can redeem your points for as little as $1!64

You’ll need to share a few things to open an account online, including your name, date of birth, contact info, SIN, address, employment status, income source(s), rent or mortgage amount, and what you’ll be using the account for.

- Be a permanent Canadian resident

- Have not declared bankruptcy in the past seven years

- Have reached the age of majority in the province in which you live (18 years in AB, MB, ON, PE, QC and SK. 19 years in all other provinces)

- Meet minimum income requirements

For Visa Infinite cards, your minimum annual income should be $60,000 (individual) or $100,000 (household). If you don't meet the income requirements, you could also qualify if you have $15,000 total spend within the last twelve months on all your other credit cards collectively, a minimum spend of $1,250 per month on application.

Yes. We’re committed to protecting your confidential information and privacy and we continuously employ the latest security software to our sites and apps.

Additionally, our digital experiences have been upgraded with extended validation (EV) SSL Certificates, which add another layer of protection by identifying our sites and applications as legitimate.

- Yes, you can! You’ll be able to set up, manage and review your PaySmart installment plans from your Online Banking account.

To get started, simply login and follow these steps for recent eligible credit card purchases of $100 or more:

- Choose an eligible credit card purchase you’d like to convert into a PaySmart plan.

- Go to the Installment Plan tab and click the Create button.

- Select the plan that works best for you.

BMO Credit Card Cardholder Agreement

Get PDF for full detailsGet all the details about the benefits that come with your card as well as your rights and responsibilities as an eclipse Visa cardholder.

Certificate of Insurance

Get PDF for full detailsThis guide outlines the terms and conditions governing the insurance that comes with your card.

Insurance Product Summary (For Quebec Residents)

Get PDF for full detailsSummary of the benefits, and key terms and conditions of the insurance that comes with your card.BMO Rewards Terms and Conditions

Get PDF for full detailsThis guide outlines in detail terms and conditions governing your BMO rewards.Important information on rates and fees

Get PDF for full detailsKey information about your BMO credit card, such as current fees, interest rates, grace period, minimum payment, foreign currency conversion and more.

® BMO is a registered trademark of Bank of Montreal.

Footnote star details Trademark of Visa International Service Association and used under license.