Newcomers to Canada

Get settled in Canada faster with a BMO credit card, no credit history required.

What is a Newcomer Credit Card?

If you’re new to Canada, a newcomer credit card helps you begin building your credit history. It’s a straightforward way to manage your spending, earn rewards, and take the first steps towards financial independence.

What you should know about credit cards

A credit card is a way for you to borrow money from a financial institution like a bank. You’re expected to pay back what you borrow by a certain date to avoid extra charges. If you miss a payment, you’ll have to pay the amount you owe plus a percentage of that amount, also known as interest.

Every credit card has a spending limit (or a credit limit) that you should avoid exceeding. For example, if a card has a credit limit of $5,000, it means you can spend up to $5,000 using this card.

Your credit history is a record of how responsible you are with borrowing money, such as whether you make your payments on time.

By building a credit history, you’ll get a credit score, which is a number between 300 and 900 that represents how well you borrowed money and paid it back.

Many companies check your credit score when deciding to lend you money and how much you can borrow, whether it’s for a credit card, mortgage or loan. The higher your credit score, the more likely a bank is to lend you money. This is why it’s good to start building your credit history as soon as you move to Canada.

In addition to allowing you to borrow money, getting a credit card lets you:

Build your credit history and increase your chances of getting approved for another credit card, loan or mortgage

Take advantage of promo offers when you sign up

Get rewards on your spending such as cash back

Enjoy perks and discounts on some services and shows

The BMO CashBack® Mastercard®* lets you easily earn cash on all your purchases, and redeem your cash back how and when it best suits you.

Conveniently cash out – You can choose if you want your cash as a recurring payment or as a one-time lump sum. Redeem any time for as low as $1 or set up an automatic recurring deposit starting at $25.

Flexible deposit options – Choose to deposit your cash back into your BMO chequing, savings or InvestorLine account.

Put it back on your card – Redeem your cash back as a statement credit.

Ready to apply for a credit card? Visit us at a BMO branch and we can chat about your options in person.

To apply for a credit card, you’ll need to provide some information about yourself, including your legal name, date of birth, contact info, SIN, address, employment status, income source(s), and rent or mortgage amount. You’ll also need to provide proof of your New to Canada status, such as your Canadian Permanent Resident Card, confirmation of Permanent Residence (IMM 5292 or IMM 5688), or your work or study permit (IMM 1442).

Also, be sure to bring two pieces of ID with you when you come into a branch.

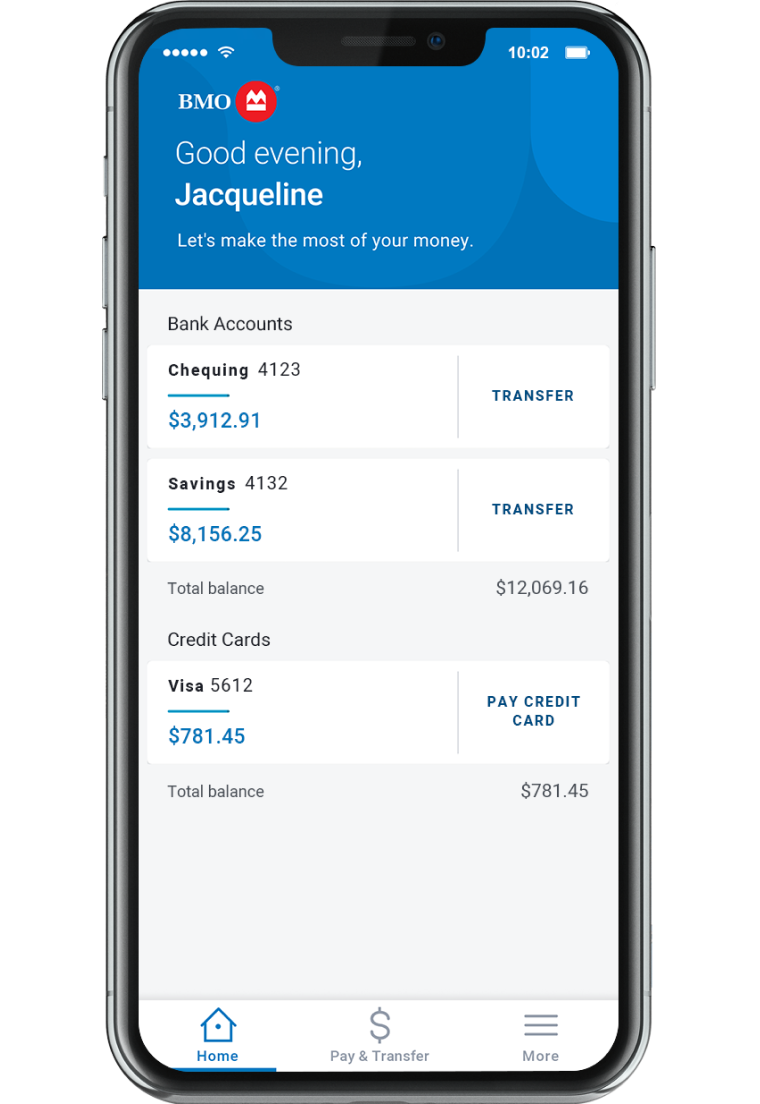

Digital features and security at your fingertips

Give your financial health a boost with online and mobile banking tools. Enjoy more control over your credit card and a better understanding about how you’re using it.

Safety and security

Can’t find your card? No worries, you can lock it, unlock it or report it lost or stolen at any time.

Financial insights

Stay on top of your spending with a personalized look at your money.

Credit Score

Get free, 24/7 access to Credit Coach with no impact to your credit score.

Dispute a transaction and PIN reset

Resolve an issue with your statement or reset your PIN directly from your mobile app.

Frequently asked questions

No, using your debit card to make payments won’t go towards building your credit. Here’s why:

When you pay with a credit card, you’re borrowing money from the card issuer. If you pay back the amount you borrowed on time, you’re basically showing your bank that you can be trusted to borrow money and pay it back by the due date – and this is how you build your credit. However, when you’re paying with a debit card, you’re not borrowing money from the bank; you’re spending your own. You’re not showing the bank that you can responsibly borrow money and pay it back. That’s why you can’t use your debit card to build your credit.

If you go over your credit limit, you may be charged an over-limit fee on your next billing cycle. It’s also important to remember that exceeding your limit can affect your credit score.

A higher credit score will help you qualify for loans and lower interest rates when you borrow. This will help you get a mortgage, buy a car, get a loan or line of credit and more. Here’s a quick breakdown:

- Poor three hundred to five hundred fifty nine

- Fair five hundred sixty to six hundred fifty nine

- Good six hundred sixty to seven hundred twenty four

- Very good seven hundred twenty five to seven hundred fifty nine

- Excellent seven hundred sixty and more

There are a few steps you can take to build your credit history in Canada:

- Get a credit card and use it regularly for things like groceries and entertainment.

- Pay your bills on time and in full if possible: Consider setting up automatic payments on recurring bills to ensure you never miss a due date.

- Use credit responsibly: Keep your balance fairly low, relative to your credit limit. Avoid reaching your credit limit every month.

- Check up on your credit: Keep track of your credit report and credit score, and be sure to follow-up with the credit bureaus if there are any errors.

Yes, you can. Once you get your credit card, you can add an additional cardholder by logging in to Online Banking and submitting a request to add an authorized user to your account.

Yes, you can. As a newcomer in Canada, you may apply for an unsecured credit card with a limit of up to $5,000 with no credit history.

If you don’t qualify for an unsecured credit card, don’t worry – you can still apply for a secured credit card where you have to pay a deposit of a certain amount to open your account.