Balance alerts for your bank account

Stay on top of your accounts and avoid unnecessary fees the easy way with balance alerts and Same Day Grace. Get email, text or app notifications to keep track of your money.

How to manage your balance alerts

Balance alert and Same Day Grace F A Qs

If you’d like to receive large withdrawal alerts, large deposit alerts or minimum balance alerts, you’ll need to sign up for each alert.

We’ll automatically enrol you in low balance alerts to protect you from NSF fees. But you can opt out any time you like through online banking or the mobile app.

Ensure that you receive Balance Alerts by keeping your contact information up to date.

You can review and edit your contact information by signing into BMO Online Banking, selecting the profile icon and then clicking on "Your information". Here you can review, edit, and update your contact details.

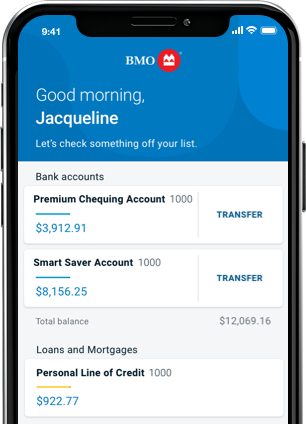

You can also review your contact information on the mobile app by logging in and selecting More and then clicking on your profile at the top of the page.

Sign into BMO Online Banking and select the profile icon in the top right corner and then click on “Alert Preferences”, or sign into BMO Mobile Banking and select “Alerts” from the “More” menu. You can then change your Alerts as you like.

Yes, you will receive a notification when your balance is below $0, but within your overdrawn limit and/or when your balance is below your overdrawn limit. If your balance is still within your overdrawn limit, you’ll be charged interest on the overdrawn amount.

If your balance drops below your overdraft limit, your transactions could be returned as Non-Sufficient Funds (NSF) and you could incur additional fees, plus interest on the overdrawn amount.

When your balance is below $0, you may be charged overdraft fees and interest on the overdrawn amount. In addition, your transactions could be returned as Non-Sufficient Funds (NSF) and additional fees may apply.

You will need to bring your account back to a positive balance; the best way to do this is to add slightly more money than the amount that your account has been overdrawn by. Keep in mind any more transactions or preauthorized payments that are scheduled for that account, you’ll need to provide enough money to cover those transactions as well to avoid NSF fees.

Here are two ways you can do that:

- Transfer funds from another account

- Make a deposit

If you deposit a cheque, it might be put on hold until the funds clear, and transactions could be returned NSF if you go beyond your available funds. Consider making a cash deposit to avoid having the funds put on hold.

Footnote star details Eligibility is subject to individual evaluation at the time of transaction (such as, but not limited to, credit profile, overdraft protection, etc.) and can change at any time. For more information, please see the Overdraft Protection page or visit a BMO branch.Please note BMO Alerts can be delivered by text message (SMS) through major Canadian wireless providers and sent from the short code 266898. You can use BMO Alerts at no additional cost from BMO. However, you are responsible for all fees charged by your mobile device service provider including standard messaging and data charges. Message frequency depends on your account settings. You can opt-out of BMO Alerts at any time by modifying your alert settings or by texting "STOP" to the short code 266898.