Understanding negative amortization

What is negative amortization?

How am I impacted by negative amortization?

Your mortgage balance will continue to increase with each installment payment instead of decreasing. As a result, your amortization period will increase, taking longer to pay off your mortgage balance.

Your installment payments at renewal will increase substantially, which can impact your financial goals.

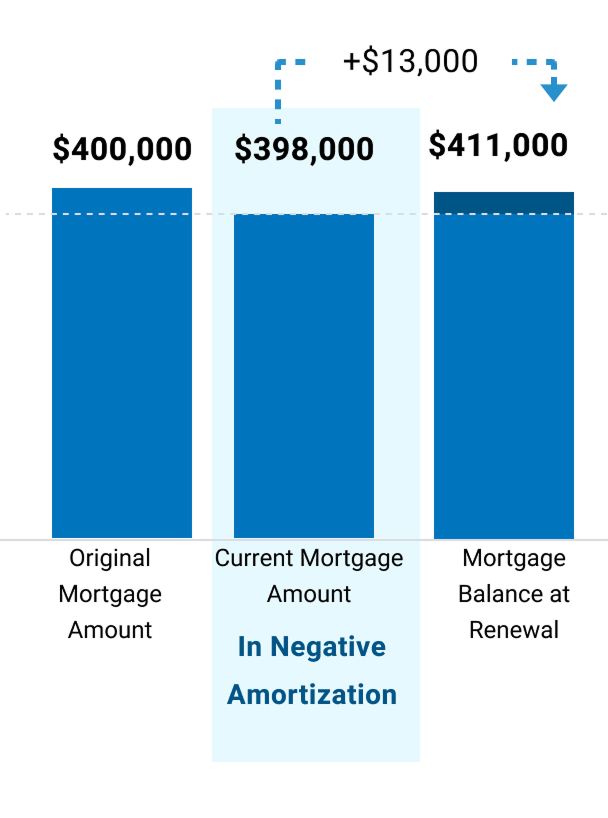

What this looks like during mortgage renewal

footnote star detailsFor illustrative purposes only. The chart assumes variable rate of 1.25% at origination in November 2021.

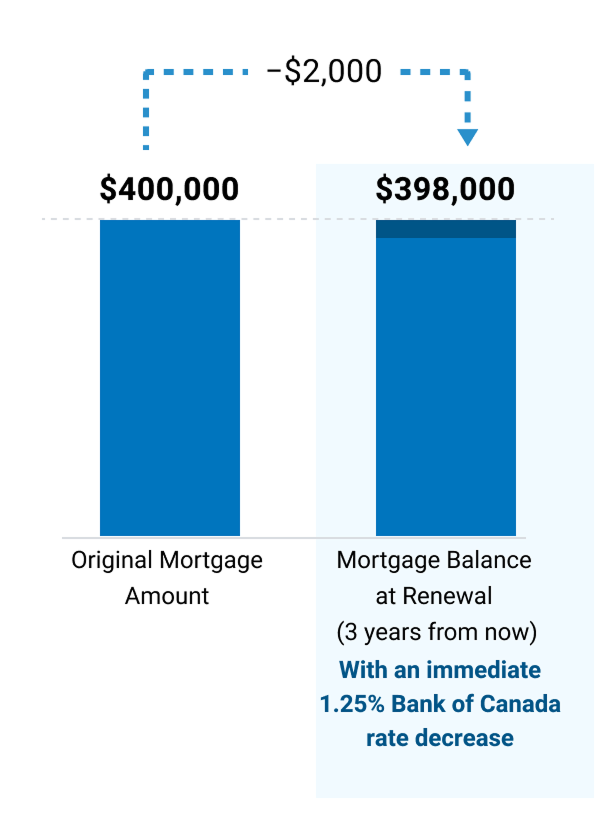

The impact of rate decreases on a mortgage in negative amortization

footnote star detailsFor illustrative purposes only.

How to get out of negative amortization

- Increase my mortgage installment payments footnote star†Reduce the gap between your payment and owed interest by making larger mortgage installment payment amounts. This is the simplest option to get out of negative amortization.

- Make a lump-sum payment footnote star††Reduce your overall mortgage balance with a one-time or recurring payment.

- Make a lump-sum payment and increase my overall paymentsCover your interest charges by increasing your overall payments and bring down your mortgage balance with a one-time or recurring payment.

- Convert to a fixed rate mortgageLock in a fixed interest rate and enjoy stability in consistent, monthly payments so you can focus on making real financial progress.

footnote star details Got a variable rate mortgage? Follow along with our demo to learn how you can make extra mortgage payments, or sign in to BMO Online Banking to get started.

F A Qs

- Here are some ways you can keep on top of your payments and avoid negative amortization:

- Make sufficient payments: Ensure that your monthly payments cover both interest and principal.

- Choose the right mortgage for you: If you think that a variable rate mortgage in negative amortization will have a large impact on your finances, consider opting for a fixed rate mortgage.

- Review your mortgage terms regularly: Periodically review your mortgage terms and payment schedule to ensure you’re on track to pay off your mortgage within your amortization period.

- Consult a Mortgage Expert: Seek advice from one of our Mortgage Experts who can guide you on mortgage options that align with your financial goals.

There isn’t a specific limit to negative amortization set by provincial or federal laws in Canada. However, mortgage regulations can change over time and vary by province or territory. Reviewing the terms of your mortgage agreement and consulting with a mortgage advisor before you sign will keep you prepared and up-to-date with current regulations.

Bringing your mortgage balance out of negative amortization is important. If left unaddressed, then your balance could keep growing instead of shrinking with each payment. This will prolong your amortization (the time it takes to pay off the mortgage) and cause payments at renewal to rise, which may impact your goals.

Note: We may raise payments to cover interest if your BMO variable rate mortgage or Homeowner ReadiLine® stays in negative amortization. We’ll let you know your new payment amount beforehand. You can check your loan agreement for more information.

- No, it doesn’t. Fixed rate mortgages remain the same throughout the term of your loan and are calculated to ensure that both the interest and principal are fully paid off by the end of the term.

- Yes. If your variable rate mortgage or Homeowner ReadiLine® stays in negative amortization and you haven’t taken action, we may increase your payments to cover interest. We’ll notify you beforehand and provide details on the new amount. You can refer to your loan agreement for more information.

This will depend on your mortgage situation. The Bank of Canada would need to cut interest rates enough so your payments cover interest charges.

- You can prepay your mortgage online by signing in to BMO Online Banking. Follow along with our demo to learn how you can quickly and conveniently make extra mortgage payments online.

Our tips and resources for you

- Footnote dagger details For variable rate mortgages, you can increase your mortgage payment to cure negative amortization without penalty. Other products terms vary, please consult our Mortgage Experts to discuss.

- Footnote dagger dagger detailsFor variable rate mortgages you can make lump-sum prepayments (minimum of $100) each year without a prepayment charge. The maximum of all prepayments per calendar year is 20% of the original mortgage amount. You can make any lump sum payment amount at renewal without a prepayment charge. Other product terms vary, please consult our Mortgage Experts to discuss.

- Footnote 1 details For illustrative purposes only. This graph is an example to demonstrate an impact of an immediate 1.25% Bank of Canada rate decrease (as of June 1, 2024) on a variable rate mortgage that is in negative amortization. At origination, the mortgage balance was $400,000, with a 25-year amortization, and a mortgage variable rate of 1.25%.