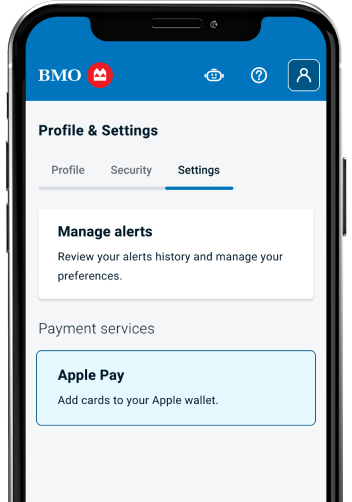

Step 1: Find and select Apple Pay

In the BMO Banking app, go to your Account Profile & Settings and select Apple Pay under Payment services.

Add your BMO cards to Apple Pay and make purchases in stores, on websites, and in apps. It’s widely accepted, simple, safe, secure, and private.

When you pay with Apple Pay, your card number won’t be shared with merchants. Instead, Apple Pay sends a virtual account number to the merchant that represents your card.

Apple Pay is accepted worldwide, in-stores, online and in-apps.

Wherever your phone goes, your BMO cards will go too. Tap your iOS device on transit, in shops and online.

Skip the hassle of manually entering your card details. With Apple Pay, you can authenticate purchases instantly using Face ID, Touch ID, or your passcode.

Adding your card to Apple Pay takes less than a minute with the BMO Mobile Banking app. Let us show you how:

In the BMO Banking app, go to your Account Profile & Settings and select Apple Pay under Payment services.

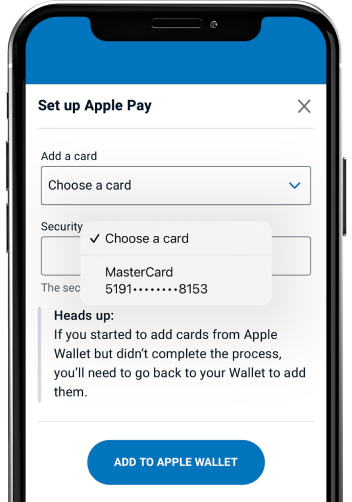

Select your BMO card from the drop down menu and enter the 3-digit security code found on the back of your card.

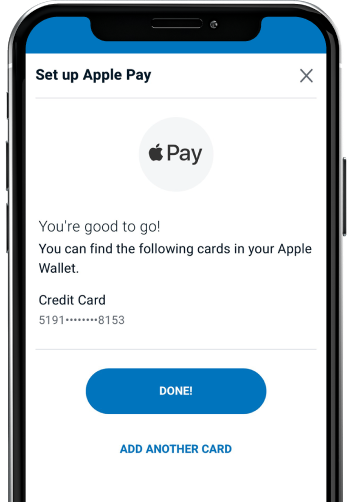

Follow the on-screen instruction to access your card on your iOS device.

Whether you’re paying with your BMO credit card or from your BMO bank account, Apple Pay makes checkout fast, easy and secure.

You can pay with your eligible iOS Device at any store that accepts contactless or mobile payments. You also can pay in apps or online at available merchants.

You can use Apple Pay outside of Canada in following countries and regions that support contactless payments. Note: Additional fees such as foreign exchange fee may be applied.

All BMO Personal and Business debit and credit cards can be added except BMO Prepaid Mastercards and Diners Club cards.

If you are experiencing issues adding your BMO Card with Apple Pay, you can try following steps:

If only one payment card is added in the Apple Pay app, it will automatically become your default card. If you have multiple payment cards, you can choose which card to use as a default card.

How to change the default card for Apple Pay on your iPhone:

How to change the default card for Apple Pay on your Apple Watch:

How to change the default card for Apple Pay on your Mac, iPad, or Apple Vision Pro

Expiring BMO Debit Card

All your personal & business BMO Debit Cards will remain active and available for purchases using Apple Pay until the date of expiry on your plastic cards. When you receive your new replacement Access Card, activate it at an ATM or by making an in-store purchase with your PIN to avoid any interruption. Once activated, you can add it to Apple Pay.

Expiring BMO Credit Card

Your personal & business BMO Credit Cards will remain active and available for purchases using Apple Pay until the date of expiry on your plastic cards. You will be mailed a new card and your new card must be activated in order to use your card. Once activated, your new card is ready to use in Apple Pay automatically.

If your BMO Personal or Business Debit Card is lost or stolen:

You can quickly report your debit card as lost or stolen and request a new card through the BMO Mobile Banking app. Just follow these steps:

A new debit card will arrive in the mail in 6 – 8 business days. You can also visit your nearest branch or call us at 1-800-361-3361 to report a missing card.

If you think your debit card has been compromised, call us at 1-800-361-3361.

If you're calling from outside North America, you can reach us at 514-881-3845.

If your BMO Personal or Business Credit Card is lost or stolen:

If you think your credit card has been lost, stolen or if you notice unusual activity on your account, notify us as soon as possible. You can quickly and easily report your card as lost or stolen through Online Banking or Mobile Banking. You can also visit your nearest branch to report your missing card.

You have the ability to suspend or remove the ability to pay from your iOS device with Apple. To learn more, visit the Apple Pay Help website

Returns with Apple Pay work the same as with your physical card—contact the merchant and provide your receipt. Bring the device you used for the purchase, and if needed, you can find the last 4 digits of your virtual account number in the card details screen of the Apple Pay app.

Yes, a per transaction limit of $250 will apply when using your debit card for Apple Pay. If you are unsure of how much you will be spending, it is a good idea to carry your BMO Debit Card as back-up.

By creating a unique virtual card number for your payment information, your name and full card details are never shown in the app and never shared with the store. If your phone is ever lost or stolen you can easily find, lock, and erase your phone using Find My App. Because you need to unlock your phone before using Apple Pay; it is just as secure as using your actual card and PIN.

You will continue to receive all the security, benefits and rewards of your cards. Apple Pay can only be used to make purchases. However, you may still need to show the merchant your loyalty card to receive rewards beyond what your credit or debit card offers.

You’re protected from unauthorized credit card purchases with Zero Liability protection (refer to your BMO Credit Cardholder Agreement). You’re also protected from unauthorized debit card purchases.2

footnote 1 details All BMO Personal & Business credit cards except BMO Prepaid Mastercard and Diners Club cards are eligible. All BMO Personal & Business debit cards are eligible, including BMO Nesbitt Burns Debit Card, BMO InvestorLine Debit Card, and BMO Private Banking Debit Cards.

footnote 2 details The use of your BMO Debit Card is governed by the Electronic Banking Services Agreement that is part of the Agreements, Bank Plans and fees for Everyday Banking; available at BMO branches and online at bmo.com/agreements. If your card is used without your authorization, you will not be liable if you did not contribute to the unauthorized use; you used reasonable care to safeguard your card and PIN; you notified us by telephone within twenty-four (24) hours after you learned of the loss, theft or misuse of your card or cheques or after you knew or suspected that someone else knows your pin. If you don’t meet these criteria, you will be liable for all charges incurred in connection with the unauthorized use.