Create your savings goals

Set up your goals in minutes and start contributing right away.

Trying to save for a vacation, travel, or school? With BMO Savings Goals, a feature on the BMO Mobile Banking app, you can set up, track, and reach your goals.

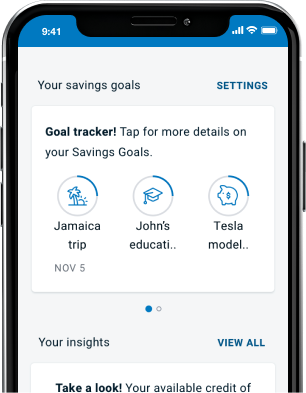

Manage your savings on the go

Set up your goals in minutes and start contributing right away.

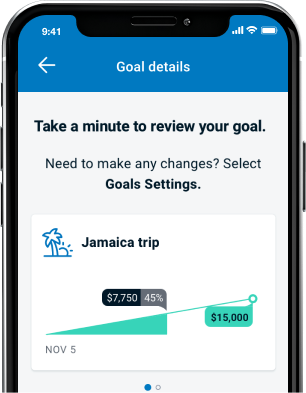

Track the progress of your goals and your savings contributions.

Edit and change goals, set new goals, and adjust your contributions.

Open an account today and enjoy all the benefits of BMO Global Money Transfer.

Savings Goals is a new mobile banking feature within the BMO mobile application. It lets you set goals, such as vacations, education and travel, helps you keep track of your contributions towards those goals and stay motivated to achieve them by linking your Canadian Savings account. This feature is currently available in English and French.

This feature is available if you have a personal savings account. You’ll also need to have the latest version of the BMO mobile app on your device and opt into the BMO Insights.

You can access the Savings Goals feature via the BMO Mobile Banking App and enrollment is easy. When you log into the BMO Mobile Banking app, you’ll receive an Invitation Insight to try the Savings Goals feature. Open the Invitation Insight and you’ll be taken to the Welcome page, where you can set up your first goal.

No problem, if you don’t have an existing savings account, the feature will ask you to open one in the BMO Mobile Banking app. You can then open a new Savings Amplifier Account, our most popular savings account, at no charge to start setting up your goals.

Any money you transfer on a weekend or holiday to a Savings account that’s linked to your savings goals will go into your Reserve fund. The money will appear in your goal(s), according to your contribution percentage, within 72 hours.

You can set unlimited goals with the Savings Goals feature!

Creating a goal is quick and easy – it takes no more than one to two minutes.

If I’ve opted out of BMO Insights, can I still enroll in the Savings Goals feature?

No, you’ll need to opt back into receiving BMO Insights to participate in the Savings Goals feature. To opt back in, go to More Menu > Insight Settings. Once you opt back in, all the Savings Goals features will be activated, and you’ll receive Insights.

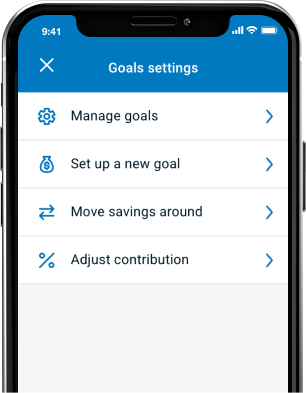

Can I move my money from one goal to another?

Yes, you can easily move money from one goal to another by going to Goals settings > Move savings around.

How can I contribute funds towards my goals?

Whenever you deposit funds into the Savings account linked to your savings goals, they will automatically be dispersed into your goal and the Reserve Fund, based on the contribution amounts you’ve set up for each goal and for the Reserve Fund. You can set a contribution ratio for your goals, ranging from 0% to 100%.

To transfer funds from one goal to another, go to Goals settings > Move savings around. If you would like to adjust your contributions to your goals, go to Goals Settings > Adjust contribution.

What is the Reserve Fund, and how does it work?

The Reserve Fund is a portion of your savings account that can be used to contribute to your savings goals. The Reserve Fund makes it easier for you to use a portion of your savings towards your savings goals.

You can set a contribution ratio for the Reserve Fund, ranging from 0% to 100%. The Reserve Fund account can’t be deleted, even if you set it to 0%, because it’s required to access the Savings Goals feature.

To move funds from the Reserve Fund to a goal, go to Goals settings > Move savings around. If you would like to adjust your contributions to the Reserve Fund, go to Goals Settings > Adjust contribution.