Who we are

As the 7th largest bank in North America by assets, we provide personal and commercial banking, global markets and investment banking services to 13 million customers. We're proud to be fueling progress for individuals, families and businesses across North America.

Explore BMO

Discover what defines us—from our commitment to responsible governance to the leaders who shape our vision and the journey that brought us here.

Business conduct

Learn more about our business conductLearn how we protect privacy, respond to complaints, and uphold ethical standards—including through our whistleblower hotline.

Leadership & governance

Explore leadership & governanceMeet the leaders guiding our organization and learn about the committees that oversee our governance and strategy.

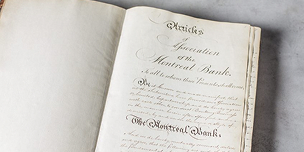

History

Explore our heritageLearn about our history and access our archives to discover the stories and milestones that define us.

Boldly Grow the Good in business and life.

Our Purpose and Values

Our reputation and success come from living our core values every day and earning the respect of people we work with and the customers and communities we serve. These values define who we are and what we stand for as an organization, unite us across business groups, cultures and geographies and guide us to do the right thing while delivering on Our Purpose: to Boldly Grow the Good in business and life.

Integrity | Inclusion | Responsibility | Empathy

Financial Performance

2025 financial performance

2025 financial performance Medium-term objectivesfootnote 1

Reported Adjustedfootnote 2 EPS growth of 7% to 10%

20.2% 25.6% ROE of 15% or more

10.6% 11.3% ROTCE of 18% or more

14.3% 14.7% Operating leveragefootnote 2 of 2% or more

2.4% 4.3% Capital ratios that exceed regulatory requirements

13.3% CET1 Ratio footnote 4

13.3% CET1 Ratiofootnote 4

3-year footnote 3 financial performance

3-year financial performance Medium-term objectivesfootnote 1

Reported Adjustedfootnote 2 EPS growth of 7% to 10% (17.0)% (2.8)% ROE of 15% or more 8.8% 11.2% ROTCE of 18% or more 12.1% 14.7% Operating leveragefootnote 2 of 2% or more (7.4)% (0.3)% BMO Financial Group has the longest-running dividend payout record of any company in Canada, at 197 years. BMO common shares had an annual dividend yield of 3.7% at October 31, 2025.

Compound annual growth rate

- 5.7% BMO 15-year

- 8.7% BMO 5-year

- footnote 1 detailsWe have established medium-term financial objectives for certain important performance measures. Medium-term is generally defined as three to five years, and performance is assessed on an adjusted basis.

- footnote 2 detailsAdjusted results and measures are non-GAAP amounts and measures and are discussed in the Non-GAAP and Other Financial Measures section of Management’s Discussion and Analysis (MD&A). Regarding the composition of non-GAAP and other financial measures, including supplementary financial measures, refer to the Glossary of Financial Terms in the MD&A.

- footnote 2 detailsPrior to November 1, 2022, we presented adjusted revenue on a basis net of insurance claims, commissions and changes in policy benefit liabilities (CCPB) and operating leverage was calculated based on revenue, net of CCPB. Beginning fiscal 2023, we no longer report CCPB, given the adoption and retrospective application of IFRS 17, Insurance Contracts (IFRS 17). Revenue, net of CCPB, was $34,393 million in fiscal 2022 and $25,787 million in fiscal 2021. Measures and ratios presented on a basis net of CCPB are non-GAAP amounts.

- footnote 3 detailsThe 3-year EPS growth rate and operating leverage, net of CCPB, reflect compound annual growth rates (CAGR).

- footnote 4 detailsThe CET1 Ratio is disclosed in accordance with OSFI’s Capital Adequacy Requirements (CAR) Guideline.

- footnote 5 detailsAs at October 31, 2025.

- footnote 6 detailsPercentages determined excluding results in Corporate Services.

- Certain comparative figures have been reclassified for changes in accounting policy.