B M O Preferred Rate Mastercard registered sign star

Give yourself a little breathing room with our lowest interest rate.

Protect your next adventure with BMO Travel Insurance

Although your credit card does not include travel insurance, we make it easy to travel confidently with our flexible travel coverage options.

Single Trip Plans: Ideal for one-time vacations or quick business trips. Get coverage for emergency medical expenses, trip cancellations, baggage loss and more.

Multi-Trip Plans: Perfect for frequent travellers. Enjoy year-round protection for unlimited trips within your chosen coverage period.

24/7 Emergency Support If you have an emergency virtually anywhere in the world, the Mastercard assistance center is available to support you 24 hours, 7 days a week.**

Extended Warranty InsuranceDoubles the original manufacturer’s warranty period on items purchased up to a maximum of one year when you charge the full purchase price to your card.97

Purchase Security InsuranceCovered items purchased in full with your card are automatically insured against theft or damage for the first 90 days from date of purchase.97

Credit Card Balance ProtectionEnrol in the Credit Card Balance Protection plan and receive up to $20,000 credit card balance coverage.

Zero LiabilitySafeguard yourself from any monetary loss resulting from fraudulent card use.

BMO AlertsManage notifications for credit card transactions, large purchases, international use and more via BMO Digital Banking or BMO Mobile Banking.

Mastercard Identity CheckAdd another layer of security to protect you when you shop online.

Add Another Cardholder For Free: Add another cardholder, free of charge.8

Optional add-on: Roadside assistance

BMO PaySmart™ Installment Plans

Live now, pay smarter with a BMO PaySmart plan by turning your credit card purchases into smaller, monthly payments at a low cost.

Ready to apply?

Start enjoying a lower interest rate.

We’ll respond in under 60 seconds.

Digital features and security at your fingertips

Give your financial health a boost with online and mobile banking tools. Enjoy more control over your credit card and a better understanding about how you’re using it.

Safety and security

Can’t find your card? No worries, you can lock it, unlock it or report it lost or stolen at any time.

Financial insights

Stay on top of your spending with a personalized look at your money.

Credit Score

Get free, 24/7 access to Credit Coach with no impact to your credit score.

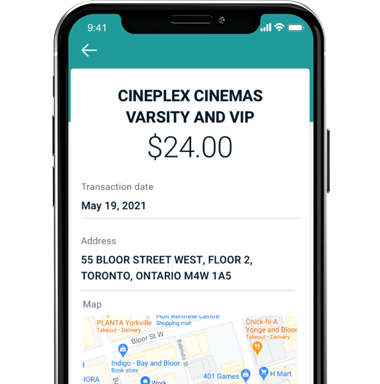

Detailed transaction view

Get a detailed view of when and where you made your purchases on the BMO mobile app.

Frequently Asked Questions

If you’re looking to save money on monthly interest payments or annual fees, a low interest option could be the best credit card for you. With a lower interest rate than most other credit cards, you’ll rack up fewer interest charges when you carry a balance; essentially, it’s cheaper to borrow money with this credit card. By paying less interest charges, you can put money towards paying off the balance on the card.

- If you have an emergency at home or away, you can contact the Mastercard Assistance Centre 24 hours a day: 1-800-247-4623 (within Canada and the U.S.)

- 1-314-275-6690 (outside North America, call collect)

There are a few requirements you need to meet to apply for a credit card with us.

- Be a Canadian citizen or permanent resident

- Have not declared bankruptcy in the past seven years

- Have reached the age of majority in the province in which you live (18 years in Alberta, Manitoba, Ontario, Prince Edward Island, Quebec and Saskatchewan. 19 years in all other provinces)

- Meet minimum income requirements

You’ll need to share a few things to open an account online, including your name, date of birth, contact info, SIN, address, employment status, income source(s), and rent or mortgage amount. The better picture we have of your financial health, the faster we can let you know if your application has been approved.

- Yes, you can! You’ll be able to set up, manage and review your PaySmart installment plans from your Online Banking account.

To get started, simply login and follow these steps for recent eligible credit card purchases of $100 C A D or more:

- Choose an eligible credit card purchase you’d like to convert into a PaySmart plan.

- Go to the Installment Plan tab and click the Create button.

- Select the plan that works best for you.

BMO Preferred Mastercard Benefits Guide

Get PDF for full detailsDiscover all the features and perks of your new credit card.

BMO Mastercard Cardholder Agreement

Get PDF for full detailsGet all the details about the benefits that come with your card as well as your rights and responsibilities as a BMO Mastercard cardholder.

Important information on rates and fees

Get PDF for full detailsKey information about your BMO credit card, such as current fees, interest rates, grace period, minimum payment, foreign currency conversion and more.

Purchase Protection and Extended Warranty

Get PDF for full detailsThis guide outlines the terms and conditions governing the insurance that comes with your card.

Insurance Product Summary (For Quebec Residents)

Get PDF for full detailsSummary of the benefits, and key terms and conditions of the insurance that comes with your card.