Welcome offer

Get the $150 annual fee rebated annually with our BMO Premium Chequing Account.††

Unlock your next adventure. Redeem your points for flights, hotels, or cruises and enjoy the same great value every time.

Get the $150 annual fee rebated annually with our BMO Premium Chequing Account.††

Minimum $80,000 (individual) or $150,000 (household) annual income required.

For every $1 spent on eligible travel purchases.9A,9B

With free membership in Mastercard Travel Pass provided by DragonPass, plus 4 free passes a year.26A

With unlimited-trips-per-year coverage for journeys up to 21 days (up to $2 million in eligible medical expenses).46

Enjoy six months of Instacart+ and a $10 monthly Instacart credit when you enroll your eligible BMO Credit Card.120

For every $1 spent on eligible travel purchases.9A,9B

For every $1 spent on eligible entertainment purchases.9A,9B

For every $1 spent on eligible dining purchases.9A,9B

For every $1 spent on recurring bill payments.9A,9B

Plus, 1x the point for every $1 spent everywhere else.9B

Minimum $80,000 (individual) or $150,000 (household) annual income required.

Ready to create unforgettable memories at home and away? Here’s what you need to know.

Minimum $80,000 (individual) or $150,000 (household) annual income required.

5x the points for every $1 spent on eligible travel purchases

3x the points for every $1 spent on eligible dining and entertainment purchases and recurring bill payments

1 point for every $1 spent everywhere else

0

Estimated yearly rewards

Enjoy six months of Instacart+ and a $10 monthly Instacart credit when you enroll your eligible BMO Credit Card.120 Terms apply.

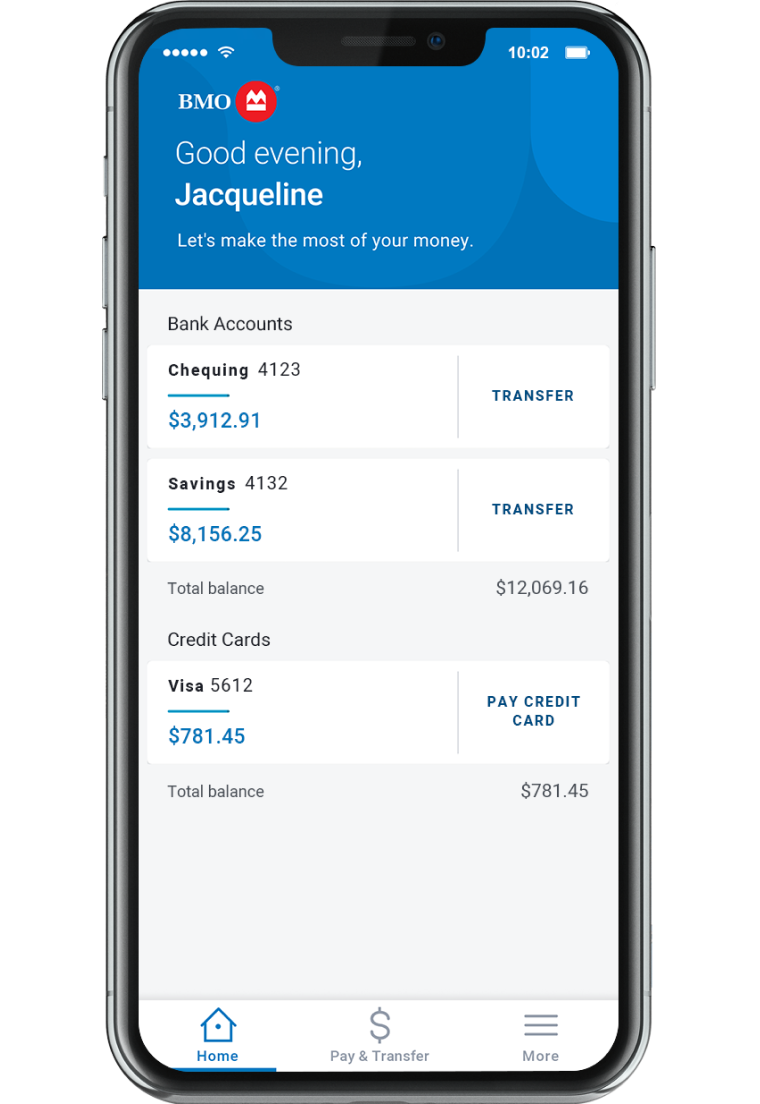

Give your financial health a boost with online and mobile banking tools. Enjoy more control over your credit card and a better understanding about how you’re using it.

Can’t find your card? No worries, you can lock it, unlock it or report it lost or stolen at any time.

Stay on top of your spending with a personalized look at your money.

Get free, 24/7 access to Credit Coach with no impact to your credit score.

Resolve an issue with your statement or reset your PIN directly from your mobile app.

footnote star details Please review the BMO Ascend World Elite Certificate of Insurance for more details.

TOP-UP INSURANCE

Your credit card already includes built-in travel insurance. With BMO Travel Insurance, you can top up your coverage for longer trips and boost your benefits for added protection beyond your existing plan.

Live now, pay smarter with a BMO PaySmart plan by turning your credit card purchases into smaller, monthly payments at a low cost.

Start earning and redeeming more rewards now.

We’ll respond in under 60 seconds.

Visit bmorewards.com to check out where your BMO Rewards points can take you or to browse our online merchandise catalogue and more.

You’ll need to share a few things to open an account online, including your name, date of birth, contact info, SIN, address, employment status, income source(s), and rent or mortgage amount. The better picture we have of your financial health, the faster we can let you know if your application has been approved.

There are a few requirements you need to meet to apply for a credit card with us.

Yes. We’re committed to protecting your confidential information and privacy and we continuously employ the latest security software to our sites and apps. Additionally, our digital experiences have been upgraded with extended validation (EV) SSL Certificates, which add another layer of protection by identifying our sites and applications as legitimate

If you have an emergency at home or away, you can contact the Mastercard Assistance Centre 24 hours a day: 1-800-247-4623 (within Canada and the U.S.)

1-314-275-6690 (outside North America, call collect)

To get started, simply login and follow these steps for recent eligible credit card purchases of $100 CAD or more: