Transparency matters. Whether quantitative or fundamental, letting investors know what’s inside an investment process helps build trust. More importantly, it gives you the affirmation that your assets are being managed proactively and responsive to future market conditions.

Unboxing the black box.

Quantitative to resist tendencies and emotion

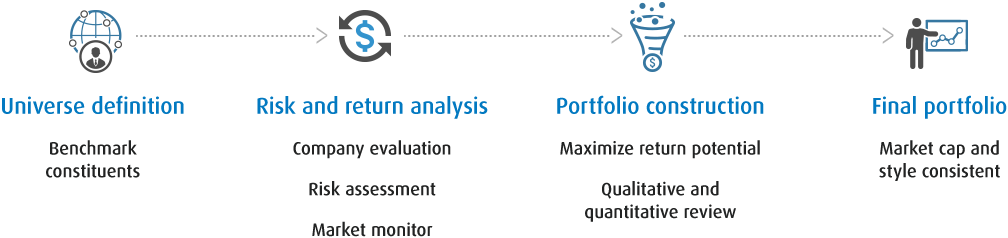

Investor bias and emotion are often sources of punishment for otherwise savvy stock market investors. Our data-driven approach brings discipline to our portfolios and helps us identify behavior-induced mispricings in the market. It’s a process we’ll take to any market at any point in the cycle.

Fundamental to interpret risk and value relationships

Investment portfolios should be built to look forward. Applying an adaptive analytical overlay to our models helps us interpret risks and trends in a stock or sector before it is reflected in valuation.

Podcast episode: Rise of the quants

“We view quantitative analysis not as an end to itself but as a means to implement fundamental views.”

David Corris, CFA

Head of Disciplined Equities, Portfolio Manager

Better conversations. Better outcomes.

Access to the portfolio managers

Read the latest insights and analysis from our U.S. Equity portfolio management team.

Ease of delivery

Subscribe to receive the latest market analysis from BMO Global Asset Management