BMO Personal Banking

What can we help you find today?

Special offers

From everyday banking to credit cards, find ways to save money and make real financial progress.

Financial resources

Access our financial resource hub to help you manage your money and plan for your future.

BMO online support

The fastest way for you to get support. Start by answering a few questions.

Innovation at BMO

Get the latest insights, trends, and stories shaping the future of banking.

Security alerts: Learn what to look for

Identify and learn how you can protect yourself against the different types of fraud.

My Financial Progress

Access our online tool that will help you manage your finances and make progress towards your financial goals.

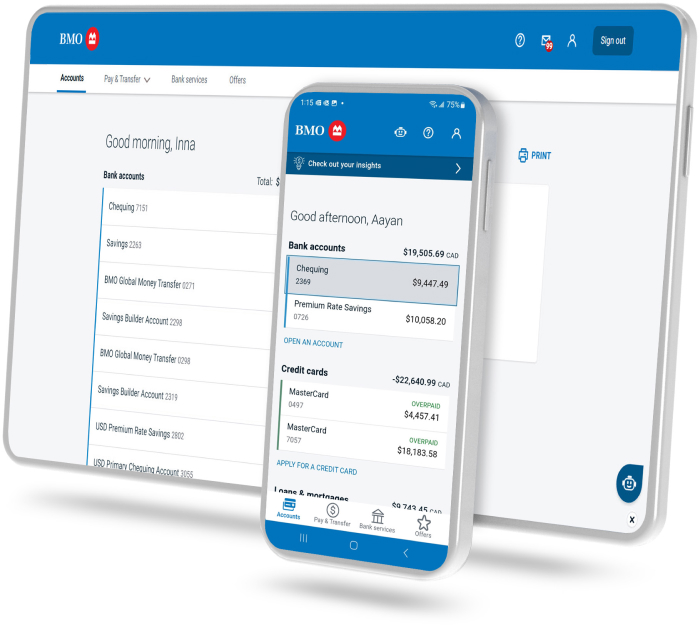

Get our award-winning mobile banking app

Our app rankednumber onein Canada for digital money management. Enjoytwenty plusfeatures – from spending insights to global transfers.

Not sure where to begin? We’ll help you choose

Credit cards

From cash back to rewards, we’ll help you choose the best credit card for you.